免责声明

本站为个人博客,分享记录个人学习过程和相关信息。所有内容如有外部来源,将会在分享时明确标注,如有遗漏,请通过邮件联系以便及时删除。未标注来源的部分(如代码等),读者可以自由使用,但需自行承担使用可能带来的后果。关于信息的准确性请读者自行鉴别,这不是科普,绝大多数情况下无法做到精准描述。

个人代码仓库

About languages

If you have some difficulties in reading Chinese, usually because you are not a native Chinese speaker. It is recommended to use the Chrome plugin Immersive Translate to read this blog. Welcome everyone to learn about my learning experience.

关于个人

我是 徐 ,此博客旨在分享技术学习和个人见解。欢迎查阅我的简历,部分信息在此。

希望能找到一个对于区块链行业有热忱的团队一起奋进。如果我的技术栈刚好符合你的需求,可以通过邮件与我进一步联系。部分技术栈不匹配的问题也可以后续跟进。

资源导航

遇到收费等情况自行斟酌,仅做推荐

电子书站点

全国图书馆参考咨询联盟 ->声名不显的网站,在国内流通的任何书籍无论冷门热门均有,包括冷门教材。获取书籍方法需要渠道,可淘宝问。

文献

娱乐影视

前端部分

联系方式

- Email:web3test1@outlook.com

- Github:https://github.com/codermaybe

个人信息

- 姓名:徐

- 性别:男

- 出生年份:2000

- 学历:本科 / 计算机系网络工程专业

- 区块链开发:1年+

- 期望职位:区块链开发(智能合约开发)

- 期望薪资:面议

- 期望城市:深圳/香港/上海/远程

- 个人主页:codermaybe.github.io

工作经历

A 公司 | 网络工程师

2023年6月 ~ 2025年2月

- 主导网络架构设计与实施,熟悉Panabit、爱快、高恪、ROS、OpenWrt等软路由系统,具备丰富的实操经验。

- 完成网络布线规划及设备选型,采用ikuai软路由+华为S5700-24TP-SI-AC方案,配置ACL、VLAN、IPSec VPN、行为管理及DPI检测分流,支持200个房间近300人同时在线,网络稳定运行近两年。

- 负责日常网络维护与优化,确保高并发场景下的流畅体验。

B 公司 | 网络工程师

2023年2月 ~ 2023年5月

- 日均处理20+家企业网络问题,服务规模涵盖20-500人,独立完成路由器选型、配置及VPN(IPSec/L2TP/PPTP)部署,实现跨平台、跨厂家设备互联互通。

- 熟练配置企业级交换机,支持大流量数据交互,具备华为、深信服、锐捷等主流网络设备的调试与故障排查能力。

- 解决多起防火墙配置问题,提升企业网络安全性及稳定性。

区块链相关

接触区块链开发领域

- 自2024.1月始-至今

技术栈

- 编程语言:Java / Rust / Solidity

- Web3开发框架及工具:

- 交互:Ethers.JS(主) / Web3.JS

- 前端:ReactJS / Web3uikit / Antd / Wagmi / HTML / JS / TS / CSS / AJAX

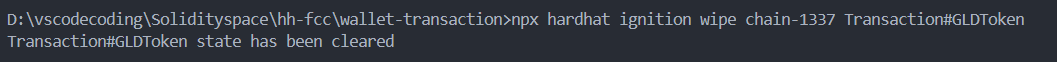

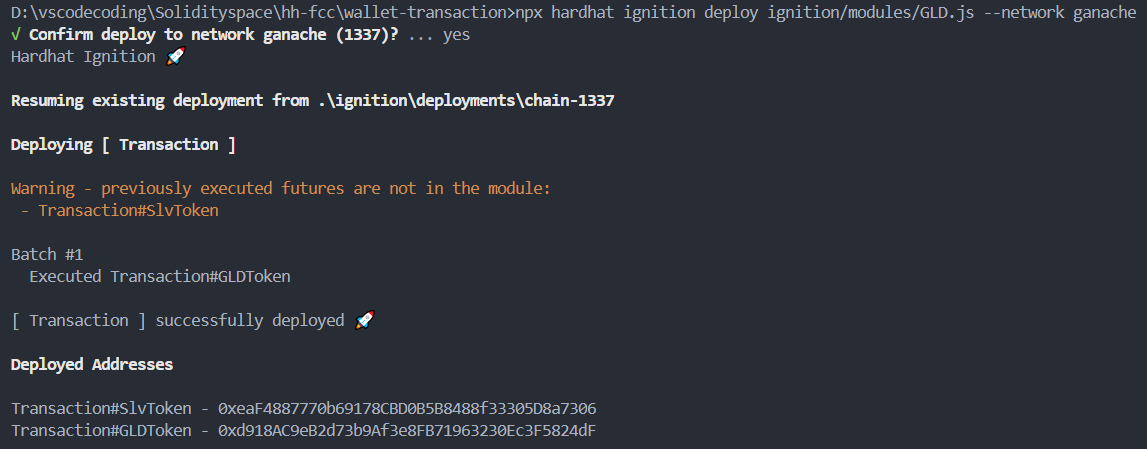

- 智能合约开发与部署:Solidity / Rust / Hardhat(含Hardhat Ignition、Hardhat Truffle等) / Ganache

- 合约检查工具:Slither

- 数据库:MySQL

- 版本管理与部署工具:Git

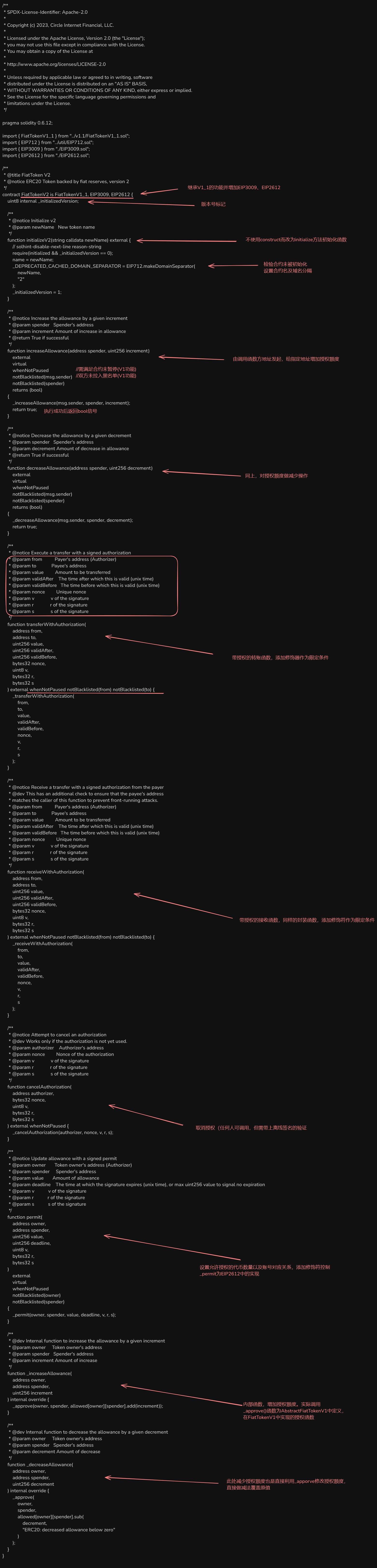

区块链能力

-

智能合约开发:

- 熟悉ERC-20、ERC-721、ERC-777、ERC-1155等标准,具备独立开发、部署和上线智能合约的经验。主要实践项目部署于以太坊测试链。

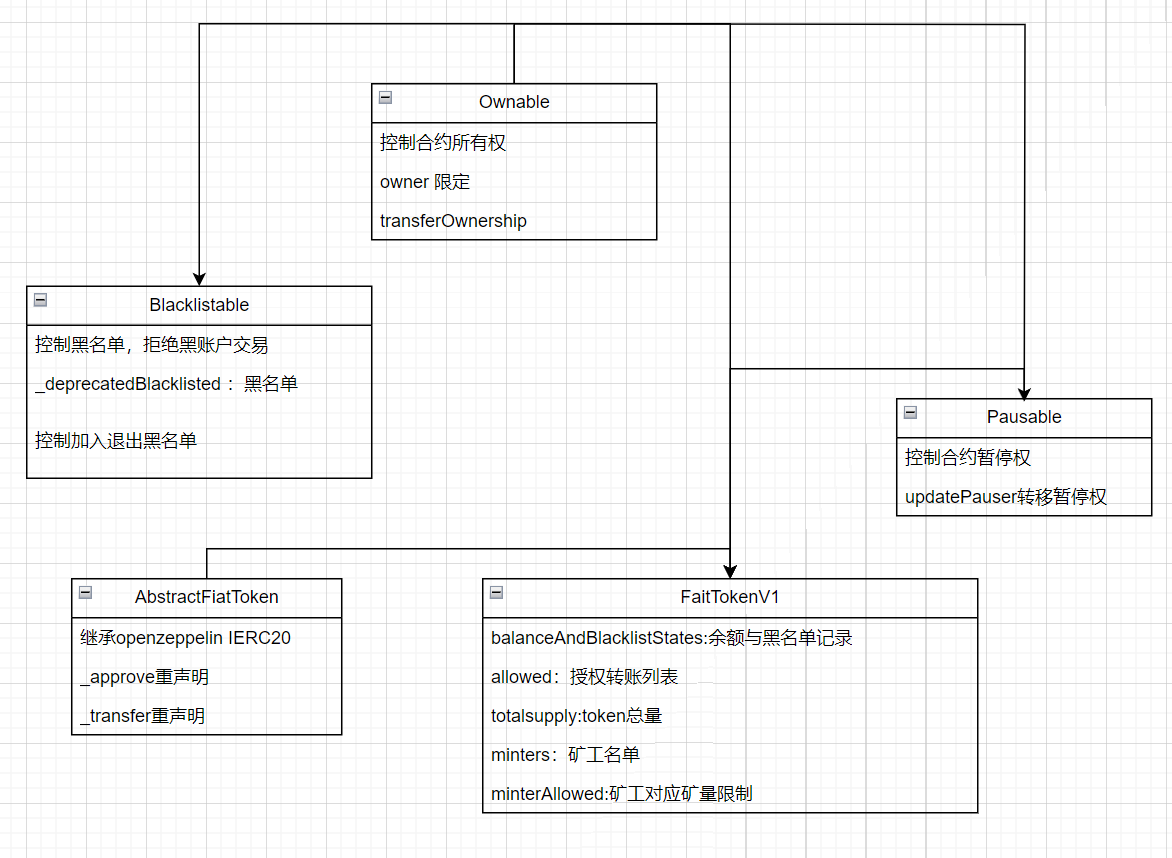

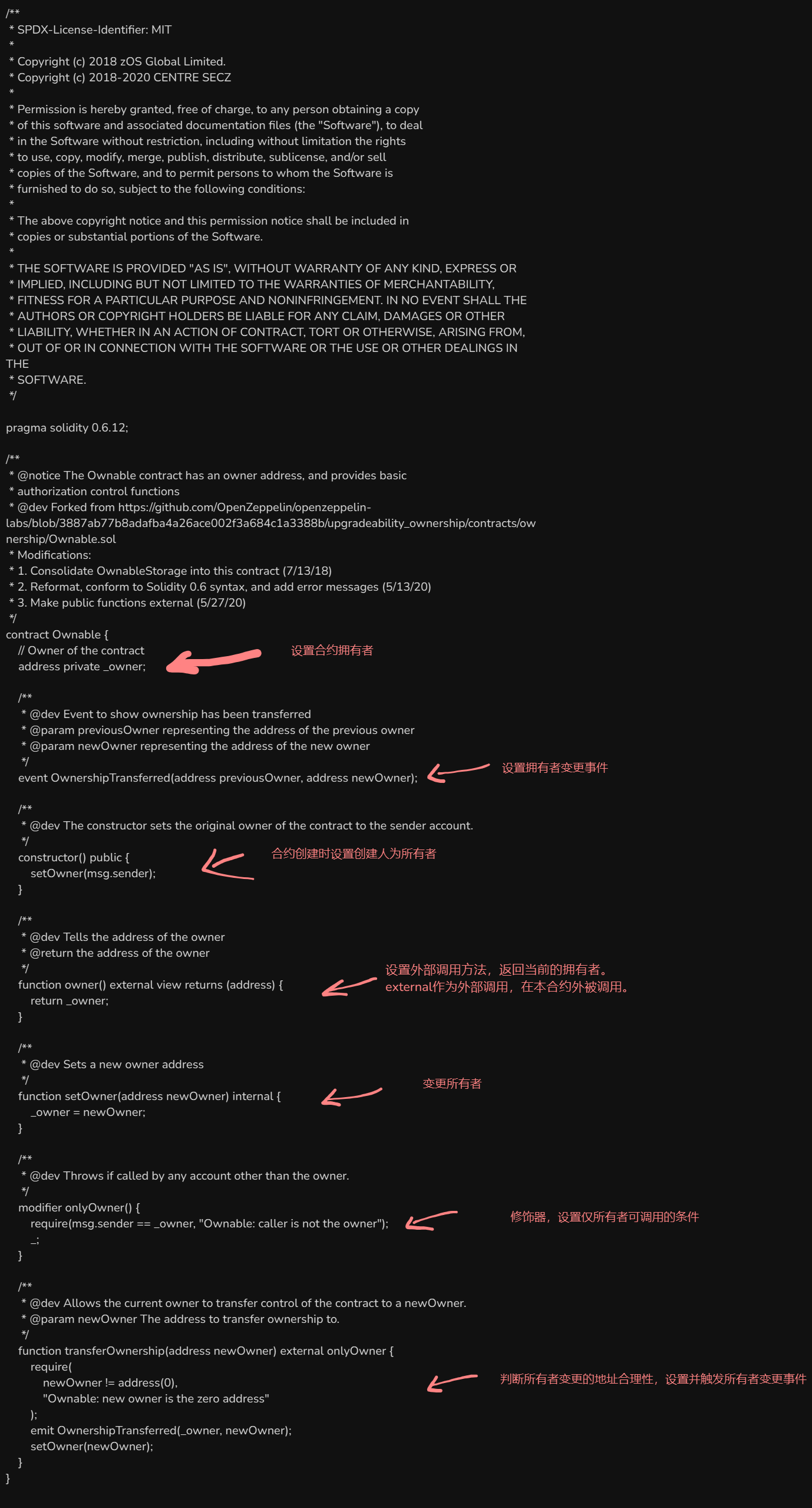

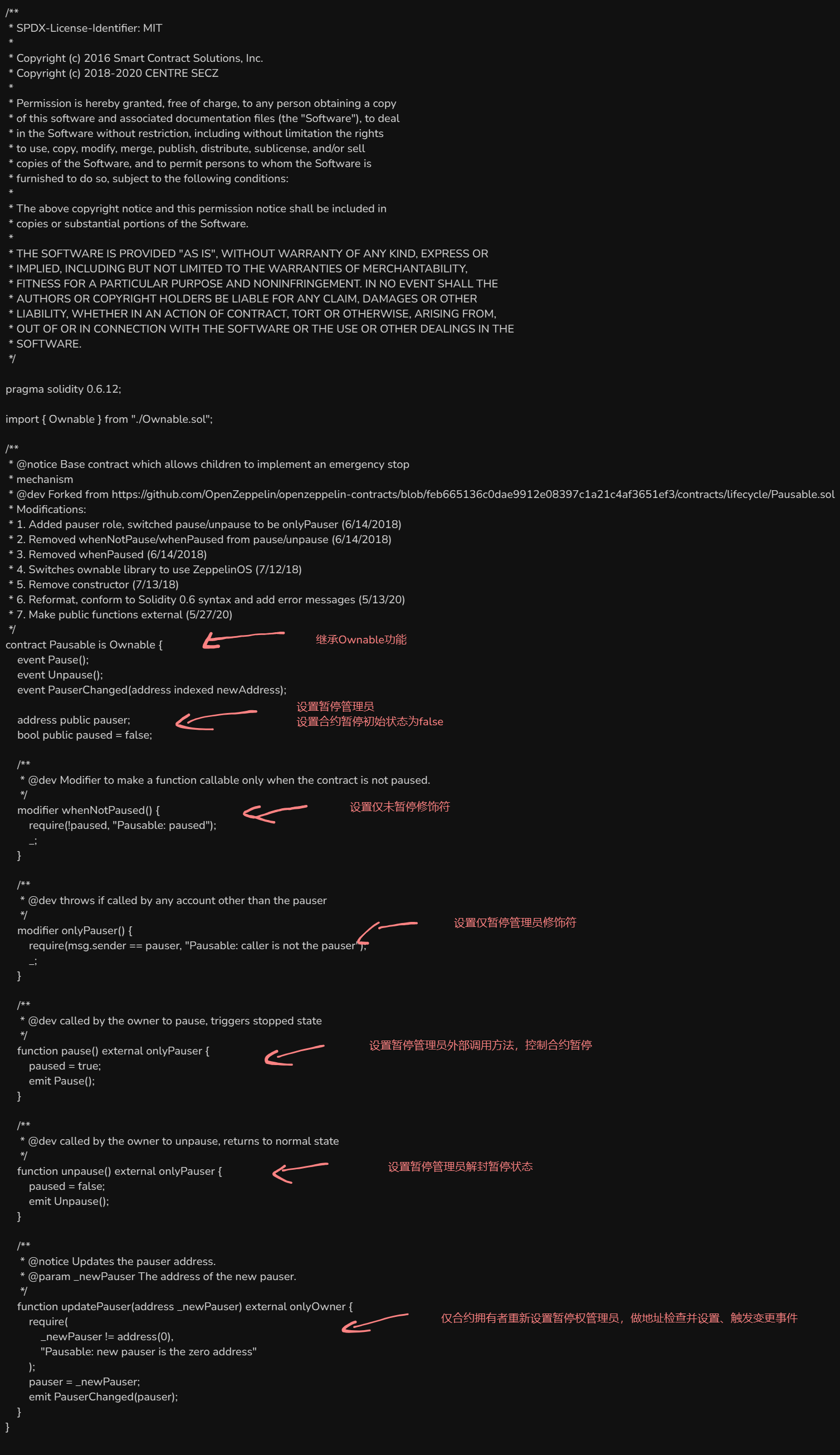

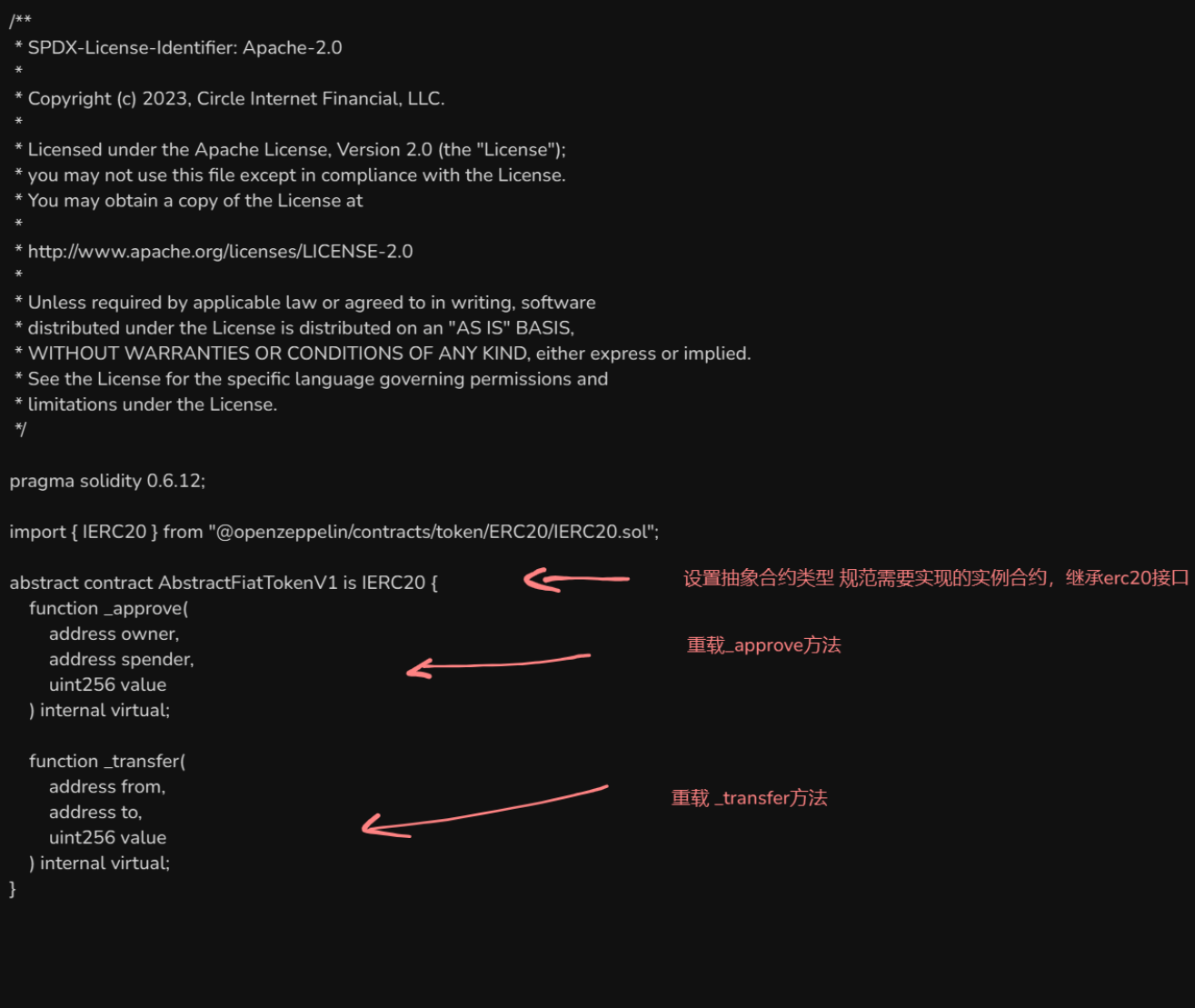

- 熟练使用OpenZeppelin安全合约库,阅读过Uniswap、USDT等项目的源码,有部分实例分析在博客中。

-

区块链生态理解:

- 了解DeFi、GameFi、DApp等发展方向,实现过简单的ERC-20流动池货币兑换项目。

- 熟悉Uniswap、Layer2、IPFS等技术实现,了解RWA、AMM、永续合约等概念及实现方式。

-

共识机制:

- 熟悉PoW、PoS、DPOS、PoH、PBFT等共识机制的原理及应用场景。

计算机基础

- 英语能力:英语六级,能流畅阅读并理解英文技术文档。

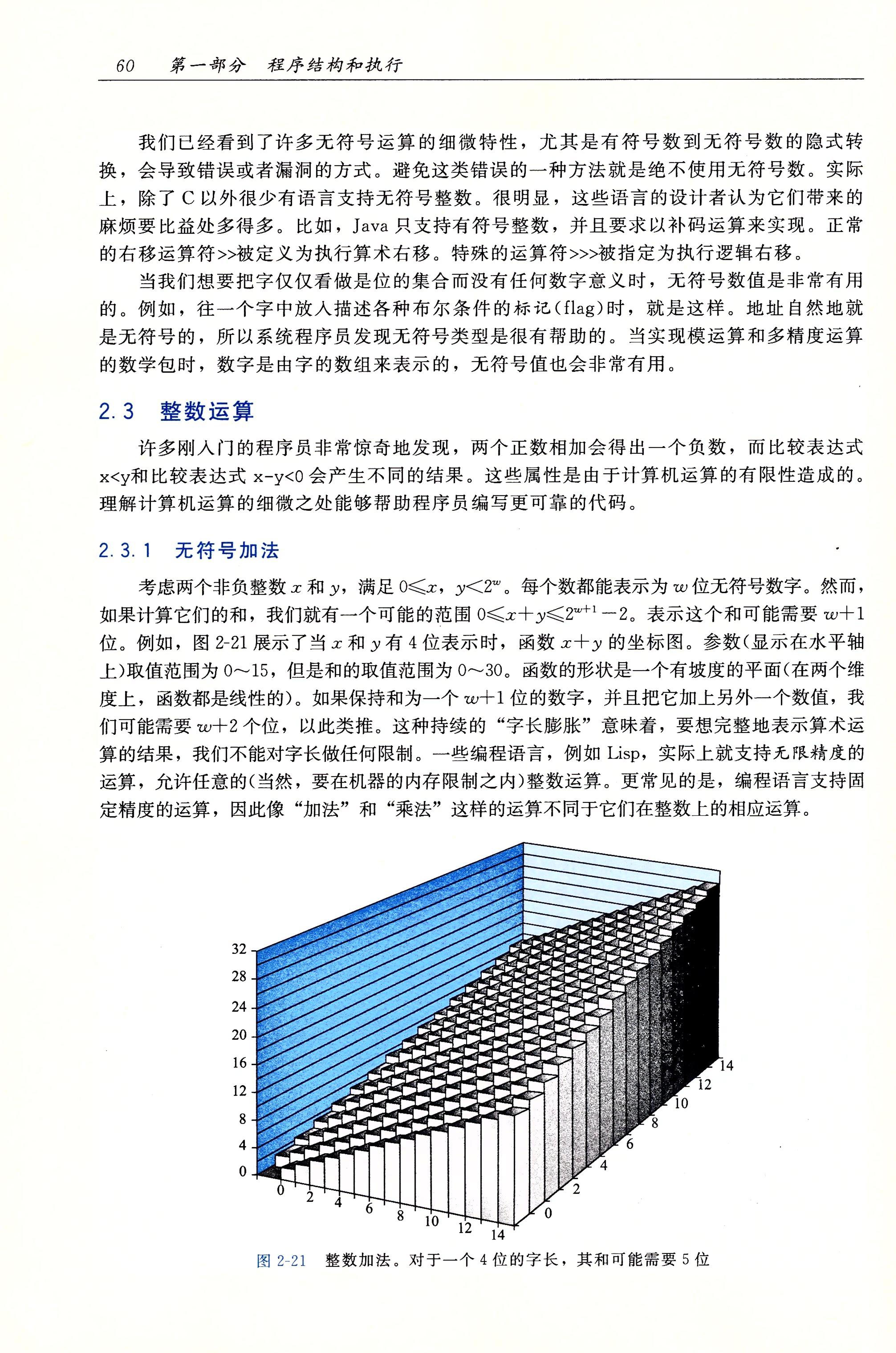

- 计算机组成:

- 熟悉CPU流水线、访存、译码、写回等阶段,了解进制转换、有符号数/无符号数计算、溢出等概念。

- 掌握汇编语言、机器指令实现方式及编译过程,熟悉计算机存储层次结构。

- 计算机网络:

- 熟悉OSI七层模型和TCP/IP模型,了解TCP协议、HTTP协议及Socket编程。

- 具备路由器、交换机、防火墙、AC+AP等网络设备的实操经验。

- Rust语言:

- 熟悉所有权系统、借用与生命周期、数据类型、函数与闭包、错误处理等核心特性。

开源项目(建议直接查看github仓库)

区块链交互工具

- 项目链接:https://github.com/codermaybe/BlockChain_InteractTools

- 功能:

- 以太坊余额查询、通用合约交互(目前仅view/pure方法可调用)。

- 随机钱包申请、转账、钱包恢复(助记词)、remix合约部署重定向。

- 区块链历史交易查询、区块链合约事件监听、代币归集等功能。

- 预计引入私钥管理,支持私钥导入、导出、管理。向完善的去中心化钱包发展。

Solidity智能合约开发

- 项目链接:https://sepolia.etherscan.io/address/0x48aeCf60f7D272Dc118409CE5FB589386d4267eE

- 描述:包含多个智能合约的部署与调用记录。

- 子项目1:区块链投票系统:初步仿造Aragon/MakerDao的治理模式,采用投票功能,暂未引入代币进行治理投票。

Rust子网转换工具

- 项目链接:https://github.com/codermaybe/IP_SubnetConverter_Flawed

- 功能:将Windows默认输出文本转换为路由条目。

毕业设计:P2P局域网聊天工具

- 项目链接:https://github.com/codermaybe/display

- 功能:支持大文件互传和实时信息传输,具有对去中心化模式的初步设想。

致谢

感谢您花时间阅读我的简历,期待能有机会和您共事!

Contact Information

- Email: mail to me

- GitHub: https://github.com/codermaybe

Personal Information

- Name: Xu

- Gender: Male

- Year of Birth: 2000

- Education: Bachelor's Degree / Network Engineering

- Blockchain Experience: 1+ year

- Desired Position: Blockchain Developer(smart contract development)

- Expected Salary: Negotiable

- Preferred Locations: Shenzhen(current)/Hong Kong/Shang Hai/Remote

- Personal Website: codermaybe.github.io

Work Experience

A company | Network Engineer

- June 2023 - February 2025

- Led network architecture design and implementation, familiar with soft router systems such as Panabit, iKuai, GaoKe, ROS, and OpenWrt, with extensive practical experience.

- Completed network cabling planning and equipment selection, using the iKuai soft router + Huawei S5700-24TP-SI-AC solution, configured ACL, VLAN, IPSec VPN, behavior management, and DPI detection and traffic distribution, supporting nearly 300 people online simultaneously in 200 rooms, with stable network operation for nearly two years.

- Responsible for daily network maintenance and optimization, ensuring a smooth experience in high-concurrency scenarios.

B company | Network Operation and Maintenance Engineer

- February 2023 - May 2023

- Handled 20+ enterprise network issues daily, serving organizations with 20-500 employees, independently completed router selection, configuration, and VPN (IPSec/L2TP/PPTP) deployment, achieving cross-platform and cross-vendor device interoperability.

- Proficient in configuring enterprise-grade switches, supporting high-traffic data interaction, with debugging and troubleshooting capabilities for mainstream network devices such as Huawei, Sangfor, and Ruijie.

- Resolved multiple firewall configuration issues, improving enterprise network security and stability.

Blockchain Related Experience

- Blockchain Development Exposure: January 2024 - Present

Technical Stack

- Programming Languages: Java / Rust / Solidity

- Web3 Development Frameworks and Tools:

- Interaction: Ethers.JS (Primary) / Web3.JS

- Frontend: ReactJS / Web3uikit / Antd / Wagmi / HTML / JS / TS / CSS / AJAX

- Smart Contract Development and Deployment: Solidity / Rust / Hardhat (including Hardhat Ignition, Hardhat Truffle, etc.) / Ganache

- Contract Inspection Tools: Slither

- Database: MySQL

- Version Control and Deployment Tools: Git

Blockchain Capabilities

- Smart Contract Development:

- Familiar with ERC-20, ERC-721, ERC-777, ERC-1155 standards, with independent experience in developing, deploying, and launching smart contracts. Main practical projects deployed on the Ethereum testnet.

- Proficient in using the OpenZeppelin security contract library, has read the source code of projects such as Uniswap and USDT, and has some instance analysis in the blog.

- Blockchain Ecosystem Understanding:

- Understands the development directions of DeFi, GameFi, DApp, etc., and has implemented simple ERC-20 liquidity pool currency exchange projects.

- Familiar with technical implementations such as Uniswap, Layer2, IPFS, and understands concepts and implementations such as RWA, AMM, and perpetual contracts.

- Consensus Mechanisms:

- Familiar with the principles and application scenarios of consensus mechanisms such as PoW, PoS, DPOS, PoH, and PBFT.

Computer Fundamentals

- English Proficiency: College English Test Band 6, able to fluently read and understand English technical documentation.

- Computer Organization:

- Familiar with CPU pipeline, memory access, decoding, write-back and other stages, understand concepts such as hexadecimal conversion, signed/unsigned number calculation, and overflow.

- Master assembly language, machine instruction implementation methods, and compilation process, familiar with computer storage hierarchy.

- Computer Networks:

- Familiar with the OSI seven-layer model and TCP/IP model, understand TCP protocol, HTTP protocol, and Socket programming.

- Practical experience with network devices such as routers, switches, firewalls, and AC+AP.

- Rust Language:

- Familiar with core features such as the ownership system, borrowing and lifetime, data types, functions and closures, and error handling.

Open Source Projects (Recommend checking the GitHub repository directly: github.com/codermaybe)

- Blockchain Interaction Tools

- Project Link: https://github.com/codermaybe/BlockChain_InteractTools

- Features:

- Ethereum balance query, general contract interaction (currently only view/pure methods can be called).

- Random wallet application, transfer, wallet recovery (mnemonic), remix contract deployment redirection.

- Blockchain historical transaction query, blockchain contract event monitoring.

- Supports transfer functions, and plans to integrate Wagmi Hooks in the future to transform into a wallet or Remix-like interaction tool.

- Solidity Smart Contract Development

- Project Link: https://sepolia.etherscan.io/address/0x48aeCf60f7D272Dc118409CE5FB589386d4267eE

- Description: Contains deployment and call records of multiple smart contracts.

- Sub-project 1: Blockchain Voting System: Preliminary imitation of Aragon/MakerDao's governance model, using voting functions, temporarily without introducing tokens for governance voting.

- Rust Subnet Conversion Tool

- Project Link: https://github.com/codermaybe/IP_SubnetConverter_Flawed

- Function: Convert Windows default output text into routing entries.

- Graduation Design: P2P LAN Chat Tool

- Project Link: https://github.com/codermaybe/display

- Function: Supports large file transfer and real-time information transmission, with preliminary ideas for a decentralized model.

Acknowledgement

Thank you for your time in reviewing my resume. I look forward to the opportunity to work with you!

区块链(BlockChain)

简介

!为保证内容严谨性简介摘自 百度百科,可访问链接查证来源

区块链(英文名:blockchain 或block chain )是一种块链式存储、不可篡改、安全可信的去中心化分布式账本 ,它结合了分布式存储、点对点传输、共识机制、密码学等技术,通过不断增长的数据块链(Blocks)记录交易和信息,确保数据的安全和透明性。

区块链起源于比特币(Bitcoin),最初由中本聪(Satoshi Nakamoto)在2008年提出,作为比特币的底层技术 。从诞生初期的比特币网络开始,区块链逐渐演化为一项全球性技术,吸引了全球的关注和投资。随后,以太坊(Ethereum)等新一代区块链平台的出现进一步扩展了应用领域 。

区块链的特点包括去中心化、不可篡改、透明、安全和可编程性。每个数据块都链接到前一个块,形成连续的链,保障了交易历史的完整性。智能合约技术使区块链可编程,支持更广泛的应用 。 区块链在金融、供应链、医疗、不动产等领域得到广泛应用。尽管仍面临可扩展性和法规挑战,但它已经成为改变传统商业和社会模式的强大工具,对未来具有巨大潜力。

当前区块链部分趋势解析

1. 加密货币:数字金融的核心引擎

加密货币(常以比特币为人熟知)作为区块链技术的起点,依然是其最重要的应用之一。从比特币的价值存储功能到以太坊生态的智能合约支持,加密货币已经从单纯的投资工具扩展到支付、储值和跨境结算等实际场景。特别是稳定币(如 USDT、USDC)和央行数字货币(CBDC)正逐步成为全球金融体系的重要组成部分。

- 热点方向:

- 稳定币:提供低波动性的支付和储值工具。

- 数字资产:将现实世界资产(如房地产、股票)代币化。

- 隐私增强:如零知识证明技术(ZKP)推动隐私性支付。

- 未来展望:随着全球监管的逐步完善,加密货币将在合法合规的框架下,进一步融入主流经济。

2. 数据存储:构建去中心化存储网络

传统数据存储方式往往面临集中化风险,而区块链赋能的去中心化存储为这一问题提供了解决方案。通过分布式存储技术,数据不仅更安全,还能实现更高效的共享和访问。

- 代表技术:IPFS(星际文件系统)、Filecoin、Arweave。

- 应用场景:

- 医疗数据:安全存储患者记录并防止数据泄露。

- 科研文献:永久存储科研成果,保证数据完整性。

- 数字资产:为 NFT 等提供长期存储支持。

- 未来展望:数据存储市场将进一步与人工智能和物联网结合,构建更大规模的数据共享网络。

3. 版权保护:为创作者经济注入新活力

数字时代,创作者面临着盗版泛滥和收益分配不透明的问题,而区块链的不可篡改特性为版权保护提供了新的解决方案。通过 NFT 和智能合约,创作者可以直接确权并实现收益的自动化分配。

- 技术工具:

- NFT(非同质化代币):用于数字艺术、音乐、视频的唯一性确权。

- 智能合约:实现收益分配的自动化和透明化。

- 代表项目:OpenSea、Async Art、Mintbase。

- 未来展望:随着区块链技术与传统版权管理体系的深度结合,更多行业将采用去中心化方式管理和保护知识产权。

4. 企业应用:赋能实体经济的数字化转型

区块链技术在企业场景中的应用正在快速增长,尤其是在供应链、物流、金融清算等领域。企业通过区块链优化流程、降低成本,并提升数据透明度。

- 当前实践:

- 防伪溯源:确保商品从生产到销售的全程可追溯性。

- 合同管理:利用智能合约实现自动化履约。

- 资产管理:数字化管理企业资产,提高运营效率。

- 未来趋势:区块链将与物联网(IoT)、人工智能(AI)结合,构建智能化、自动化的企业运营网络。

区块链技术正以多维度的方式重塑各个行业。从加密货币到数据存储、版权保护,再到企业应用,其发展方向不仅展示了技术的潜力,也为数字经济与实体经济的深度融合开辟了新路径。在未来,我们有理由期待区块链技术在更多领域的突破和落地,推动社会迈向一个更加开放、透明、高效的新时代。

未来的可能

1. 跨链互操作性

不同区块链之间的孤立性正在限制其大规模应用。未来,跨链技术将实现资产、数据和智能合约的跨链流通,为区块链生态系统的融合提供动力。

- 关键技术:Polkadot、Cosmos、桥接协议(Bridges)。

- 潜在影响:

- 实现链间的无缝交互。

- 推动更多复杂场景的落地。

2. 隐私保护与合规

随着数据隐私和合规性需求的增长,零知识证明(ZKP)、多方计算(MPC)等隐私增强技术将在金融、医疗等敏感数据场景中发挥重要作用。

- 技术前景:

- 更安全的隐私保护交易。

- 满足法规要求的合规区块链解决方案。

3. Web3 的普及

Web3 的发展将赋予用户对数据的完全掌控权,重新定义数字身份(DID)、去中心化存储和应用生态。

- 可能的变革:

- 用户数据自主权的增强。

- 去中心化社交媒体和内容平台的崛起。

4. 社会公益与可持续发展

区块链技术可以支持公益透明化、碳排放追踪和绿色金融发展,为社会带来更多正向价值。

- 应用场景:

- 环保项目:追踪碳信用交易。

- 公益捐款:确保资金流向透明。

疯狂的商机

1. 数字艺术与收藏品

随着 NFT 的兴起,数字艺术市场呈现爆炸式增长。艺术家和创作者能够通过区块链直接向全球观众出售作品,同时确保所有权和版税收益。

- 商业模式:

- 创建独特的数字艺术品。

- 提供 NFT 交易和拍卖平台。

- 潜在利润:

- 高价值艺术品销售。

- 平台交易手续费收入。

2. 游戏经济和虚拟世界

区块链赋能的游戏正重塑游戏行业,玩家可以真正拥有游戏内资产并通过交易获利。例如,"Play-to-Earn" 模式已吸引了大量玩家和投资者。

- 盈利模式:

- 虚拟道具销售。

- 游戏内资产的 NFT 化和交易。

- 成功案例:Axie Infinity、The Sandbox。

3. 去中心化金融(DeFi)

DeFi 提供了无需中介的金融服务,包括借贷、交易和收益农场。其透明性和高收益吸引了大量用户,成为区块链最具活力的领域之一。

- 商机:

- 创建创新性的 DeFi 协议。

- 提供流动性挖矿激励。

- 潜在收益:

- 协议交易费用。

- 流动性提供者的分红。

4. 元宇宙生态建设

元宇宙作为一个虚拟与现实结合的世界,区块链是其关键技术之一。开发虚拟地产、虚拟商品以及元宇宙平台将成为新的商业热点。

- 盈利方向:

- 虚拟地产销售。

- 虚拟活动门票和商品交易。

- 未来前景:元宇宙将吸引更多品牌和用户,带来持续的商业机会。

区块链技术不仅在当前热点领域中发挥着重要作用,其未来可能性更是为人类社会的方方面面带来了无限想象空间。从技术突破到实际应用,区块链正在塑造一个更加开放、透明和可持续的未来。

区块链基础

自2008年比特币诞生以来,区块链技术逐渐成为重构信任机制的核心支柱。其本质是通过分布式账本和密码学算法,实现去中心化、不可篡改的数据记录与价值传递。

一、区块链的核心原理

-

分布式账本

区块链通过将数据存储于全网多个节点,构建去中心化的数据库。每个节点持有完整账本副本,交易需经多数节点验证后写入。例如,比特币网络由约12,000个节点(截至2025年3月)共同维护,确保数据一致性。节点数的动态变化反映了网络的开放性与活力。 -

共识机制

共识算法是节点达成数据一致性的关键,常见类型包括:- 工作量证明(PoW):比特币通过算力竞争验证交易,安全性高但能耗巨大。

- 权益证明(PoS):以太坊2.0采用质押机制,能耗降低约99%,已成为主流趋势。

- 实用拜占庭容错(PBFT):适用于联盟链,通过多数派投票高效达成共识。

-

不可篡改性

每个区块包含前序区块的哈希值,形成链式结构。修改任一数据需重算后续所有区块,计算难度呈指数级增长。以比特币为例,截至2025年3月,其区块链已累积约83万个区块,篡改成本近乎天文数字。

二、区块链的技术架构

区块链可分为三层结构:

-

协议层

- 存储层:采用Merkle树结构存储交易数据,支持高效验证。

- 网络层:基于P2P协议(如比特币的TCP通信)实现节点间数据同步。

- 加密层:依托非对称加密(如ECDSA)和哈希算法(如SHA-256),保障交易安全。

-

扩展层

提供开发接口以支持复杂应用。例如,以太坊通过Solidity语言实现智能合约,比特币闪电网络提升交易速度。2025年,Layer 2技术(如Rollups)进一步优化了扩展性。 -

应用层

覆盖多领域典型应用:- DeFi:去中心化交易所Uniswap和借贷平台Aave推动金融革新。

- 溯源:京东区块链防伪平台已覆盖超60万种商品(截至2024年数据,2025年预计更多)。

- 司法存证:杭州互联网法院利用区块链固化电子证据,提升司法效率。

三、区块链的分类与典型场景

-

分类

- 公有链:完全开放,如比特币和以太坊,无中心化控制。

- 联盟链:多方共管,如R3 Corda和蚂蚁链,适用于金融结算。

- 私有链:企业内部使用,如沃尔玛供应链管理,兼顾效率与隐私。

-

典型场景

- 跨境支付:传统SWIFT需3-5天,Ripple将时间缩短至2-3小时,已与Santander等银行合作。

- 供应链金融:区块链将应收账款数字化,降低中小企业融资门槛。

- 数字身份:新加坡“乌敏岛项目”通过区块链管理公民数据,提升隐私与安全性。

四、挑战与未来方向

-

现存问题

- 可扩展性:比特币每秒处理7笔交易(TPS),远低于VISA的65,000 TPS。

- 能源消耗:PoW机制年耗电量约60 TWh,相当于瑞士全年用电。

- 监管缺失:DeFi的匿名性增加了非法资金流动风险。

-

技术演进

- 分片技术:以太坊2.0通过64个分片将TPS提升至数万,2025年已初见成效。

- 零知识证明:Zcash的zk-SNARKs技术实现交易隐私保护,广泛应用于隐私链。

- 跨链互操作:Polkadot和Cosmos推动链间资产互通,加速Web3生态融合。

- Layer 2普及:Arbitrum等解决方案大幅提升吞吐量,成为2025年技术热点。

推荐链接: dappradar.com

1. 金融领域深化应用(核心方向)

- 去中心化金融(DeFi):基于以太坊等公链构建借贷、交易、衍生品平台,2023年DeFi总锁仓量已突破千亿美元。

Uniswap

- 供应链金融:通过区块链实现多方信息透明共享,降低信任成本,解决中小企业融资难题。

- 跨境支付与结算:如瑞波币(Ripple)通过联盟链提升跨境支付效率,减少中间环节费用。

- 数字资产证券化:利用智能合约实现资产Token化,提升流动性,典型案例如房地产和艺术品投资。

2. 企业级区块链解决方案(主战场)

- 联盟链与私有链主导:企业更倾向采用强管理的联盟链(如Hyperledger Fabric)优化供应链管理、数据存证等场景,提升协作效率。

- BaaS(区块链即服务):云服务商(如AWS、阿里云)集成区块链模块,降低企业部署成本,加速应用落地。

- 行业标准建设:金融、物流等领域制定区块链技术标准,如工信部发布的《区块链隐私保护规范》。

3. 跨行业扩展与实体经济融合

- 物联网与供应链管理:区块链+物联网实现设备数据可信上链,优化物流追踪与溯源(如IBM Food Trust)。

- 医疗健康:患者数据加密共享,提升跨机构协作效率,同时保障隐私。

- 政务与司法存证:多地政府采用区块链技术实现电子证照、司法证据存证,增强公信力。

4. 技术创新与生态扩展

- 跨链技术:解决多链互通问题,Polkadot、Cosmos等项目推动跨链协议发展,支撑价值互联网构建。

cosmos sdk

- Layer2扩容方案:如Optimism、zkSync通过Rollup技术提升以太坊交易吞吐量,降低Gas费用。

- 隐私计算结合:零知识证明(ZKP)与同态加密技术增强交易隐私性,应用于匿名币(如Zcash)和合规金融场景。

5. 监管合规与标准化

- STO(证券型代币)取代ICO:通过合规化代币发行降低风险,美国SEC已推动相关监管框架。

- 全球监管协作:如区块链协会发布《数字资产市场结构原则》,强调保护用户自托管权利与跨境协作。

- 反洗钱(AML)与KYC:各国要求交易所和钱包服务商纳入传统金融监管体系,如FATF“旅行规则”。

6. 新兴领域探索

- Web3.0与去中心化身份(DID):构建用户自主控制的数据身份体系,如以太坊的ERC-725标准。

- 元宇宙与NFT:区块链支撑虚拟资产确权与交易,NFT应用扩展至游戏、艺术和知识产权领域。

- 碳中和与能源管理:通过区块链追踪碳足迹,激励绿色能源交易,如Power Ledger项目。

未来趋势关键点

- 技术融合:区块链与AI、物联网、边缘计算结合,形成分布式信任网络。

- 去中心化与监管平衡:在合规框架下探索DAO(去中心化自治组织)等新模式。

- 基础设施升级:高性能公链(如Solana)和模块化架构(如Celestia)推动大规模商用。

区块链共识机制

共识机制是区块链技术的核心组成部分,它解决了分布式系统中的一个基本问题:如何在没有中央权威的情况下,让网络中的所有参与者就交易的有效性和顺序达成一致。以下是主要的区块链共识机制、它们的工作原理以及各自的优缺点。

共识机制的基本概念

在分布式系统中,共识是指网络中的节点就某一状态达成一致的过程。区块链作为一种特殊的分布式账本技术,其共识机制需要解决以下问题:

- 双花问题:防止同一数字资产被花费两次

- 拜占庭将军问题:在存在恶意节点的情况下达成一致

- 系统可靠性:确保系统即使在部分节点失效的情况下仍能正常运行

- 交易顺序:确定交易的顺序并将其写入区块链

主要共识机制

1. 工作量证明 (Proof of Work, PoW)

工作原理:

- 节点(矿工)通过解决复杂的数学难题来竞争区块的生成权

- 解决难题需要大量计算资源

- 第一个找到解决方案的矿工获得将新区块添加到链上的权利并获得奖励

代表项目:

- 比特币 (Bitcoin)

- 莱特币 (Litecoin)

- 以太坊 (Ethereum) 在2022年9月之前

优点:

- 安全性高,攻击成本高(需要51%的算力)

- 已被实践证明的可靠性

- 去中心化程度高

缺点:

- 能源消耗巨大

- 交易处理速度慢

- 随着算力集中可能导致中心化趋势

2. 权益证明 (Proof of Stake, PoS)

工作原理:

- 区块生成者(验证者)基于其持有的加密货币数量(权益)被选中

- 验证者通过质押自己的代币来获得验证交易的权利

- 恶意行为将导致质押资产被罚没

代表项目:

- 以太坊2.0 (Ethereum 2.0)

- 卡尔达诺 (Cardano)

- 索拉纳 (Solana)(使用历史证明的PoS变种)

优点:

- 能源效率高

- 更高的交易吞吐量

- 持币者有动力维护网络安全

缺点:

- "富者更富"的潜在问题

- 理论上的安全性争议

- 可能导致权益集中

3. 委托权益证明 (Delegated Proof of Stake, DPoS)

工作原理:

- 持币者通过投票选出有限数量的"代表"或"见证人"

- 这些代表负责验证交易和生成区块

- 代表表现不佳可能被投票替换

代表项目:

- EOS

- TRON (波场)

- Lisk

优点:

- 极高的交易处理速度

- 能源效率高

- 治理机制更为明确

缺点:

- 中心化程度较高

- 可能形成"寡头政治"

- 参与门槛较高

4. 实用拜占庭容错 (Practical Byzantine Fault Tolerance, PBFT)

工作原理:

- 基于多轮投票达成共识

- 能在有限数量的恶意节点存在的情况下保持系统安全

- 通常需要已知且有限的验证节点集合

代表项目:

- 超级账本 (Hyperledger Fabric) --联盟链常用

- Zilliqa (结合PoW使用)

- NEO

优点:

- 交易最终性快

- 无需大量计算资源

- 高吞吐量

缺点:

- 适合许可链而非公有链

- 节点数量增加会影响性能

- 需要节点身份验证

5. 权威证明 (Proof of Authority, PoA)

工作原理:

- 区块由预先选定的权威节点(验证者)生成

- 验证者通常需要公开身份,声誉作为质押

- 适合联盟链和私有链场景

代表项目:

- VeChain

- 以太坊测试网络 (Rinkeby, Goerli)

- xDai Chain

优点:

- 高性能和可扩展性

- 能源效率高

- 交易成本低

缺点:

- 中心化程度高

- 信任依赖于验证者

- 不适合完全公开的场景

新兴共识机制

1. 可验证随机函数 (Verifiable Random Function, VRF)

Algorand等区块链使用VRF来随机选择提议者和验证委员会,结合了PoS的能效与抽签的公平性。

2. 容量证明 (Proof of Capacity/Space)

存储空间替代计算能力作为资源证明,如Chia网络使用"空间和时间证明"(Proof of Space and Time)。

3. 历史证明 (Proof of History)

Solana引入的时间戳机制,创建历史记录证明事件发生的顺序,提高交易处理速度。

共识机制的演进趋势

随着区块链技术的发展,共识机制呈现以下趋势:

- 环保趋势:从能源密集型向环保型转变

- 可扩展性提升:追求更高的TPS(每秒交易数)

- 安全与去中心化的平衡:寻找三难困境(去中心化、安全性、可扩展性)的最佳平衡点

- 混合共识:结合多种共识机制的优势

- 链下扩展:Layer 2解决方案与主链共识机制的协同

结论

共识机制是区块链技术的灵魂,不同的应用场景和需求催生了各种共识算法。随着技术的不断演进,更高效、更安全、更环保的共识机制将继续涌现,推动区块链技术走向更广泛的应用。

没有一种"完美"的共识机制适合所有场景,区块链项目需要根据自身的特点和目标用户群体选择最合适的共识算法,或者开发创新的混合解决方案。随着行业的成熟,共识机制的设计将变得更加精细和专业化,以满足特定领域的需求。

工作量证明 (Proof of Work)

深入浅出:什么是PoW共识机制?

如果你听说过比特币或区块链,可能对“挖矿”这个词不陌生。而挖矿的核心,就是 PoW(Proof of Work,工作量证明) 共识机制。本文将探讨PoW的定义、工作原理、优缺点及其历史背景。

PoW的本质

PoW是一种通过计算“工作量”实现网络共识的机制。在区块链中,参与者(称为矿工)通过解决数学难题证明其投入的计算资源。成功解题的矿工可将新区块添加到链上并获得奖励。PoW依靠“工作量”的可验证性和高计算成本,确保系统的安全性和去中心化。

以比特币为例,其难题基于 SHA-256哈希函数:矿工需找到一个随机数(Nonce),使区块数据的哈希值满足特定条件(如具有一定数量的前导零)。这一过程需要大量试错计算,体现了PoW的“工作”特性。

PoW的工作原理

- 交易收集:网络中的交易被打包进候选区块。

- 难题挑战:矿工调整Nonce,反复计算哈希值,直到结果符合难度要求。

- 验证答案:全网节点验证哈希是否有效,确保共识一致。

- 广播与确认:有效区块被添加到区块链,矿工获得代币奖励。

- 持续循环:过程重复,驱动区块链扩展。

篡改区块需重算后续所有工作量,因算力竞争的存在,这种攻击成本极高,使得PoW网络高度安全。

PoW的优点

- 安全性高:发起51%攻击需控制全网过半算力,在成熟网络(如比特币)中几乎不可行。

- 去中心化:无需许可,任何拥有计算资源的个体均可参与。

- 规则透明:奖励与算力直接相关,机制公开公平。

PoW的缺点

- 能耗巨大:高算力需求导致显著的电力消耗,引发环保争议。据估算,比特币网络年耗电量可媲美一些中小型国家。

- 效率较低:交易吞吐量受限,例如比特币每秒处理约7笔交易。

- 算力集中:专用设备(如ASIC)的普及使小型矿工难以竞争,算力逐渐向大矿池集中。

PoW的历史背景与技术意义

PoW的起源可以追溯到计算机科学和密码学的早期研究。1993年,Cynthia Dwork 和 Moni Naor 在一篇论文中提出了一种基于计算成本的方案,旨在防御垃圾邮件。他们设计了一种机制,要求发送者解决计算难题以证明诚意,这一想法成为PoW的雏形。1997年,Adam Back 推出了 Hashcash,利用SHA-1哈希函数生成特定难度的输出,用于抵御邮件轰炸和DDoS攻击。Hashcash直接启发了比特币的PoW设计。

2008年,中本聪(Satoshi Nakamoto) 在《比特币:一种点对点电子现金系统》白皮书中将PoW引入区块链,结合分布式账本和经济激励,解决了“双重支付”问题。中本聪的创新在于将Hashcash的单次证明扩展为动态调整难度的持续竞争机制,确保网络随算力增长保持约10分钟的出块时间。2009年1月3日,比特币创世区块生成,PoW成为首个成功运行的区块链共识算法。

早期,PoW被广泛采用,如Ethereum(2015-2022年)、Litecoin和Monero等。但随着技术进步,PoW的局限性显现。2022年9月15日,以太坊通过“The Merge”转向PoS,标志着对PoW的部分反思。尽管如此,PoW作为区块链技术的起点,其通过算力和数学建立信任的范式,开创了去中心化数字经济的先河。

权益证明(Proof of Stake)

- 代表链:ETH

深入浅出:什么是PoS共识机制?

如果你对比特币的PoW(工作量证明)有所了解,那么PoS(Proof of Stake,权益证明)可能是你听到的另一个热门共识机制。作为区块链技术的替代方案,PoS因其低能耗和高效率备受关注。今天,我们来聊聊PoS的原理、运作方式及其优缺点。

PoS的本质

与PoW通过计算“工作量”不同,PoS基于参与者的“权益”来决定谁有权创建新区块。在PoS系统中,“权益”通常指用户持有的加密货币数量及其持有时间。简单来说,持有越多代币并“锁定”越久的人,越有可能被选中来验证交易并添加区块。这种机制用经济投入取代了算力竞争。

在PoS区块链中,验证者(Validator)不是通过挖矿,而是通过质押(Stake)代币参与共识。被选中的验证者负责打包交易并获得奖励,而作弊(如伪造区块)会导致质押的代币被没收。

PoS的工作原理

- 质押代币:用户将一定数量的代币锁定在网络中,作为参与共识的“保证金”。

- 随机选择:系统通过算法(通常结合代币数量和质押时间)随机选择一名验证者。

- 区块创建:被选中的验证者验证交易并生成新区块。

- 全网确认:其他节点验证区块的有效性,达成共识。

- 奖励分配:验证者获得交易费或新发行的代币作为回报。

PoS的关键在于“随机性”和“经济惩罚”:选择过程看似随机,但倾向于持有更多代币的参与者;若验证者行为不当,其质押的代币将被“销毁”。

PoS的优点

- 能耗低:无需大量算力,PoS的能源消耗远低于PoW,更加环保。

- 效率高:交易确认速度快,吞吐量更高(如以太坊PoS后可达数千TPS)。

- 去中心化潜力:普通用户更容易参与,不依赖昂贵的挖矿设备。

PoS的缺点

- 富者愈富:持有更多代币的人更容易被选中,可能加剧财富集中。

- 安全性争议:相比PoW,PoS对网络攻击(如“长程攻击”)的抵御能力仍需验证。

- 初始分配问题:代币分配不均可能导致早期持有者占据主导。

PoS的历史背景与技术意义

PoS的概念最早出现在2011年,由QuantumMechanic在Bitcointalk论坛提出,旨在解决PoW的高能耗问题。2012年,Peercoin(PPC)成为首个采用PoS的加密货币项目,引入了“币龄”(Coin Age)的概念,即代币持有时间越长,获得记账权的概率越高。此后,PoS逐渐发展出多种变体,如纯PoS、DPoS(委托权益证明)和LPoS(租赁权益证明)。

以太坊的转型是PoS历史上的里程碑。2015年以太坊推出时采用PoW,但创始人Vitalik Buterin早已计划转向PoS。2022年9月15日,以太坊完成“合并”(The Merge),正式从PoW切换至PoS,成为迄今规模最大的PoS网络。这一转变不仅将能耗降低了约99.95%,还推动了PoS在主流区块链中的应用。

PoS的理论基础与博弈论和经济学密切相关。它假设参与者是理性的经济人,会因害怕失去质押资产而遵守规则。与PoW的算力竞争不同,PoS通过经济激励和惩罚构建信任,代表了区块链共识机制从“资源消耗”向“资源持有”的范式转变。

Proof of History(PoH)是什么?

Proof of History(PoH,历史证明) 是由Solana团队开发的一种时间排序机制,旨在通过加密时间戳和可验证延迟函数(VDF)记录事件顺序,提升区块链的性能和可扩展性。PoH并非独立的共识算法,而是与Proof of Stake(PoS)结合使用,专注于解决分布式系统中时间同步的效率问题,为高吞吐量区块链提供了创新基础。

使用Proof of History(PoH)的区块链项目

以下是截至2025年2月28日,已知与PoH直接关联的区块链项目及其应用情况:

1. Solana

- 概述:Solana是PoH的主要实现者,作为一个高性能Layer 1区块链,支持大规模去中心化应用(DApps)。

- PoH作用:Solana将PoH作为其架构的核心组件,与PoS结合。PoH通过生成连续的时间戳序列,标记交易和事件的顺序,减少节点间的时间同步需求,从而实现高吞吐量。

- 特点:

- 高吞吐量:理论峰值超65,000 TPS,实际表现约为2,000-3,000 TPS(视网络状况)。

- 低延迟:区块时间约400毫秒。

- 应用场景:DeFi(如Serum)、NFT(如Magic Eden)、区块链游戏等。

- 现状:截至2025年,Solana已成为领先公链之一,其生态系统持续扩展。

2. Filecoin(探索性研究)

- 概述:Filecoin是一个去中心化存储网络,基于Proof of Replication(PoRep)和Proof of Spacetime(PoSt)。

- PoH关联:Filecoin本身不使用PoH,但社区和研究者曾探讨将其集成到架构中,以优化时间戳验证或存储证明效率。

- 特点:

- PoH可能提升数据检索的排序效率。

- 目前仅为理论提案,未在主网实现。

- 现状:PoH在Filecoin中未被正式采用,仅停留于实验讨论。

3. Arweave(潜在计划)

- 概述:Arweave是一个永久存储区块链,使用Proof of Access(PoA)和“Blockweave”结构。

- PoH关联:Arweave未正式采用PoH,但其团队曾提及探索类似时间排序机制的可能性,以改进数据验证效率。

- 特点:

- PoH或可优化交易顺序记录。

- 无明确证据显示已实现整合。

- 现状:截至2025年,PoH在Arweave中仍属概念性讨论,未进入实际部署。

其他相关项目

- Hashgraph:Hedera Hashgraph是一种基于DAG的分布式账本技术,其事件排序机制与PoH有相似之处,但使用的是“Gossip about Gossip”和虚拟投票协议,非PoH。

- 小型实验链:一些未具名的区块链项目可能在研究PoH,但缺乏公开文档和影响力,无法确认。

PoH的应用前景

PoH的核心优势在于高效的时间排序,使其适用于需要高吞吐量和低延迟的场景,如金融交易和实时应用。然而,VDF的计算需求可能限制普通节点参与,引发中心化争议。Solana的成功表明PoH的潜力,未来或有更多项目借鉴其设计。

PoH的核心特点

-

时间序列生成

PoH通过连续哈希运算生成不可篡改的时间记录,证明事件发生的顺序。 -

与PoS协同

PoH不决定区块生产者,而是为PoS提供时间框架,由质押的验证者负责区块确认。 -

高效性

通过本地计算替代网络通信,PoH显著提升交易处理速度。

PoH的工作原理

PoH基于SHA-256哈希函数和可验证延迟函数(VDF),其运作流程如下:

- 一个领导节点(Leader)持续运行哈希运算,将前一输出作为下一输入,形成单向的时间序列。

- 交易和事件嵌入此序列,记录其相对时间戳。

- 其他节点验证序列的正确性,因VDF的单向性,无需重新计算即可确认。

- 在Solana中,PoS验证者轮流担任领导者,根据PoH序列打包并确认区块。

此设计将时间同步负担转移至本地计算,极大减少了网络通信开销。

PoH的优缺点

优点

- 高吞吐量:支持数千至数万TPS,适用于大规模应用。

- 低延迟:区块确认时间短,提升用户体验。

- 可扩展性:为高性能区块链提供了技术支持。

缺点

- 硬件要求:生成PoH序列需要高性能硬件,可能提高参与门槛。

- 集中化风险:领导节点的轮换若不平衡,可能削弱去中心化。

- 应用范围有限:目前主要在Solana中实现,其他项目采用较少。

PoH的历史与愿景

PoH由 Anatoly Yakovenko 于2017年首次提出,当时他试图解决分布式系统中时间协调的低效问题。传统共识如PoW依赖算力排序交易,耗能且缓慢;PoS虽降低能耗,仍需频繁通信以同步状态。Yakovenko受到密码学中VDF研究的启发,提出用加密手段生成时间序列,减少节点间依赖。

2018年2月,PoH在《Solana: A new architecture for a high performance blockchain》白皮书中正式亮相,结合PoS和VDF奠定了Solana的技术基础。2019年3月,Solana测试网上线,验证了PoH的可行性。2020年3月16日,Solana主网Beta版启动,PoH投入实际运行。此后,Solana凭借PoH实现的高性能迅速崛起,至2025年已成为公链领域的标杆。

未来,PoH可能在高吞吐量场景(如物联网、金融科技)中获得更多应用,尽管其硬件依赖性仍需优化。

PBFT共识机制

在分布式系统和区块链领域,PBFT(Practical Byzantine Fault Tolerance,实用拜占庭容错) 是一种经典共识算法,旨在应对节点故障和恶意行为。

PBFT的本质

PBFT由Miguel Castro和Barbara Liskov于1999年提出,用于解决拜占庭将军问题。它确保系统在至多1/3节点发生任意故障(包括恶意行为)时仍能达成一致,适用于节点数量有限的分布式网络。

PBFT的工作原理

PBFT通过三阶段协议实现共识,假设总节点数n,最大容错节点数f,需满足n ≥ 3f + 1:

- 预准备(Pre-prepare):主节点接收客户端请求,分配序列号并广播提议。

- 准备(Prepare):各节点验证提议合法性,广播准备消息,需收到

2f + 1个一致确认。 - 提交(Commit):节点收到

2f + 1个准备确认后广播提交,达成共识并执行。

若主节点失效,视图切换(View Change)机制触发,选举新主节点。通信复杂度为O(n²)。

PBFT的优缺点

优点

- 强容错性:可容忍不超过

(n-1)/3个拜占庭节点。 - 高效性:无需算力竞争,延迟低。

- 最终性:达成共识后状态不可逆。

缺点

- 扩展性差:节点数增加时通信开销激增。

- 前提条件:需已知节点身份,不适合完全开放系统。

PBFT的应用

PBFT常见于许可链,如Hyperledger Fabric的共识模块,以及Tendermint(Cosmos SDK基础)。它适用于金融、供应链等需高效一致性的场景。

拜占庭容错(BFT)共识机制

概述

拜占庭容错(Byzantine Fault Tolerance,BFT)是一种分布式系统容错机制,最早由 Lamport、Shostak 和 Pease 在 1982 年的论文《The Byzantine Generals Problem》中提出。该机制能够使分布式系统在存在恶意节点(拜占庭节点)的情况下仍然保持一致性。

基本概念

拜占庭将军问题

拜占庭将军问题描述了一个场景:多个拜占庭将军需要共同决定是否进攻,但其中可能存在叛徒。叛徒可能会:

- 发送错误的信息

- 不发送信息

- 发送相互矛盾的信息

系统假设

-

节点类型:

- 诚实节点:始终遵循协议

- 拜占庭节点:可能任意行为

-

网络假设:

- 异步网络

- 消息可能丢失或延迟

- 消息可能被篡改

-

安全性要求:

- 一致性:所有诚实节点达成相同决定

- 有效性:如果所有诚实节点初始值相同,则最终决定为该值

经典 BFT 算法

PBFT(Practical Byzantine Fault Tolerance)

PBFT 由 Castro 和 Liskov 在 1999 年提出,是第一个实用的 BFT 算法。

算法流程

-

预准备阶段(Pre-prepare):

Primary -> All: <PRE-PREPARE, v, n, m>σp- v:视图号

- n:序号

- m:消息内容

- σp:主节点签名

-

准备阶段(Prepare):

All -> All: <PREPARE, v, n, m, i>σi- i:节点编号

- σi:节点签名

-

提交阶段(Commit):

All -> All: <COMMIT, v, n, i>σi -

回复阶段(Reply):

All -> Client: <REPLY, v, t, i, r>σi- t:时间戳

- r:执行结果

安全性保证

-

容错能力:

- 支持 f 个拜占庭节点

- 需要至少 3f + 1 个总节点

- f = (n-1)/3,其中 n 为总节点数

-

一致性证明:

- 如果两个诚实节点在视图 v 中提交了不同的值,则存在矛盾

- 通过 quorum 交叉确保一致性

HotStuff

HotStuff 是 Facebook Libra 采用的 BFT 算法,是对 PBFT 的改进。

主要改进

-

线性视图变更:

- 视图变更更简单

- 减少通信复杂度

-

三阶段提交:

- Prepare

- Pre-commit

- Commit

-

流水线优化:

- 支持并发处理

- 提高吞吐量

应用场景

-

区块链系统:

- Hyperledger Fabric

- Libra

- Tendermint

-

金融系统:

- 支付系统

- 清算系统

- 证券交易

-

分布式存储:

- 文件系统

- 数据库

- 配置管理

性能考虑

-

通信复杂度:

- 消息数量:O(n²)

- 其中 n 为节点数量

-

延迟:

- 至少需要 3 轮通信

- 网络延迟影响性能

-

吞吐量:

- 受节点数量限制

- 通常支持数十到数百节点

安全考虑

-

攻击防护:

- 重放攻击

- 消息伪造

- 视图切换攻击

-

密钥管理:

- 密钥生成

- 密钥分发

- 密钥更新

-

网络安全:

- 消息认证

- 加密传输

- 防篡改机制

最佳实践

-

节点配置:

- 合理设置节点数量

- 考虑地理位置分布

- 确保网络连接质量

-

性能优化:

- 使用批处理

- 实现流水线

- 优化网络传输

-

监控告警:

- 节点状态监控

- 性能指标收集

- 异常行为检测

总结

BFT 共识机制是分布式系统中解决拜占庭容错问题的关键技术。通过 PBFT、HotStuff 等算法,我们可以在存在恶意节点的情况下保证系统的一致性和可用性。在实际应用中,需要根据具体场景选择合适的算法,并注意性能和安全性的平衡。

HotStuff共识机制:区块链中的高效BFT解决方案

引言

在分布式系统和区块链技术中,共识机制是确保节点间状态一致性的核心组件。传统的拜占庭容错(Byzantine Fault Tolerance, BFT)协议,如PBFT(Practical Byzantine Fault Tolerance),在安全性上表现出色,但在通信复杂度和性能扩展性上面临挑战。HotStuff作为一种新型的BFT共识协议,结合了高效性、响应性(responsiveness)和线性通信复杂度,成为近年来备受关注的解决方案。

HotStuff作为一种创新的BFT共识协议,通过三阶段投票、线性通信和管道化设计,为区块链和分布式系统提供了高效、安全的解决方案。它不仅改进了传统BFT协议的扩展性瓶颈,还为现代区块链应用奠定了技术基础。尽管存在一些局限性,但其设计理念和实践价值已得到广泛认可。随着研究的深入,HotStuff及其变种有望在更多场景中发挥作用,推动分布式共识技术的进一步发展。

HotStuff概述

HotStuff由VMware Research团队于2018年提出,并在2019年的PODC会议上正式发表。它是一种基于领导者(leader-based)的BFT共识协议,运行于部分同步(partially synchronous)网络模型中。HotStuff的目标是解决传统BFT协议(如PBFT)的痛点,同时满足区块链系统对高吞吐量、低延迟和可扩展性的需求。

HotStuff的关键特性包括:

- 响应性(Responsiveness):在网络通信同步后,协议的推进速度取决于实际网络延迟,而非预设的最大延迟。

- 线性通信复杂度:通过优化通信模式,HotStuff将通信开销从传统BFT的平方级别(O(n²))降低到线性级别(O(n))。

- 三阶段提交规则:采用独特的“三链”(Three-Chain)提交规则,确保安全性和活跃性(liveness)。

- 领导者轮换:支持频繁的领导者替换,提升系统鲁棒性。

HotStuff的这些特性使其成为Facebook(现Meta)的Libra(后更名为Diem)项目中LibraBFT共识协议的基础。

HotStuff的核心设计

1. 系统模型

HotStuff假设一个由n个节点组成的系统,其中最多f个节点可能出现拜占庭故障(n ≥ 3f + 1)。网络模型为部分同步,即存在一个未知的全局稳定时间(GST),在此之前网络可能是异步的,之后变为同步。节点通过消息传递进行通信,所有消息均经过数字签名以确保不可伪造。

2. 三阶段协议

HotStuff的核心是其三阶段投票机制,与PBFT的两阶段(Pre-Prepare和Commit)不同。HotStuff的三个阶段分别为:

- Prepare:领导者提出一个新区块,收集至少2f+1个节点的投票,形成Prepare Quorum Certificate(Prepare QC)。

- Pre-Commit:领导者广播Prepare QC,节点验证后投票,领导者收集2f+1个投票形成Pre-Commit QC。

- Commit:领导者广播Pre-Commit QC,节点投票并锁定该提案,领导者收集2f+1个投票形成Commit QC,完成提交。

每个阶段的投票都被聚合为一个Quorum Certificate(QC),通过阈值签名(threshold signature)实现高效验证。相比PBFT,额外的Pre-Commit阶段解决了“隐藏锁”(hidden lock)问题,确保新领导者在视图切换(view change)时能安全接管。

3. 线性通信复杂度

传统BFT协议(如PBFT)在视图切换时需要所有节点广播其状态,导致通信复杂度为O(n²)。HotStuff通过“星型通信”(star communication)优化了这一过程:

- 节点仅与当前领导者通信,发送投票。

- 领导者聚合投票并广播QC。

这种模式将通信复杂度降至O(n),显著提高了协议的可扩展性,尤其在节点数量较多时优势明显。

4. 领导者轮换与管道化

HotStuff支持频繁的领导者轮换,每轮共识后可更换领导者,增强了系统的公平性和抗攻击能力。此外,HotStuff引入了“链式”(Chained)设计,将多个区块的共识过程管道化:

- 一个区块的Prepare QC可作为下一个区块的依据。

- 通过连续的“三链”结构(Prepare → Pre-Commit → Commit),实现高吞吐量。

例如,当第N个区块完成Commit时,第N+1个区块可能已进入Pre-Commit,第N+2个区块进入Prepare。这种管道化设计充分利用了网络带宽,提升了整体性能。

5. 安全性和活跃性

- 安全性(Safety):HotStuff通过三阶段投票和QC锁定机制,确保不会出现冲突提交。即使在异步网络中,只要不超过f个节点故障,协议仍是安全的。

- 活跃性(Liveness):通过Pacemaker机制(超时触发视图切换),HotStuff保证在GST后,系统能在正确领导者的带领下达成共识。

HotStuff与PBFT的对比

| 特性 | PBFT | HotStuff |

|---|---|---|

| 通信复杂度 | O(n²) | O(n) |

| 投票阶段 | 两阶段 | 三阶段 |

| 响应性 | 无 | 有 |

| 领导者替换 | 复杂且开销大 | 简单且高效 |

| 管道化支持 | 无 | 有 |

HotStuff在通信效率和灵活性上优于PBFT,尤其适用于大规模分布式系统。

HotStuff在区块链中的应用

HotStuff因其高效性和可扩展性,被广泛应用于许可型区块链(permissioned blockchain)场景:

- LibraBFT:Libra项目的共识协议直接基于HotStuff,优化了其在金融场景下的性能。

- SafeStake:一个支持以太坊2.0 staking的中间层协议,利用HotStuff提升去中心化程度。

- Cypherium:结合HotStuff与PoW,探索混合共识的可能性。

在这些应用中,HotStuff通过线性通信和管道化设计,显著提升了交易吞吐量和确认速度,同时保持了BFT的安全性。

优势与局限性

优势

- 高性能:线性通信和管道化实现高吞吐量和低延迟。

- 可扩展性:适用于大规模节点网络。

- 鲁棒性:频繁领导者轮换减少单点故障风险。

局限性

- 延迟增加:三阶段设计在正常情况下比两阶段协议多一次通信。

- 复杂性:管道化和阈值签名的实现对开发和调试提出了更高要求。

- 性能攻击脆弱性:在某些情况下,恶意节点可能通过分叉攻击降低吞吐量。

针对这些问题,后续研究提出了改进版本,如Fast-HotStuff(两阶段优化)和HotStuff-2(简化投票流程),进一步提升效率和鲁棒性。

此小节记录部分个人学习密码学所阅读的读物

保命声明!!!

非网安、信安专业,非密码学精通人士。

个人阅读并汇总的资料,极少量的代码实现。实现算法的逻辑仅做收集,个人无法目前设计和完全实现。

附大量引导链接,尽可能不误导读者。

Ed25519:现代数字签名算法的原理与应用(附 Rust 实现)

请务必阅读此小章关于密码学

-

推荐链接 偏通识

-

不太推荐但是放上来的链接 需要丰富的密码学相关经验

1. 什么是 Ed25519?

Ed25519 是一种基于 Edwards-curve Digital Signature Algorithm (EdDSA) 的高效签名方案,使用 Curve25519 椭圆曲线。其特点包括:

- 128 位经典安全性(不抗量子计算)。

- 确定性签名:无需随机数生成器,避免 ECDSA 的随机数重用风险。

- 64 字节签名:紧凑且易于处理。

- 高性能:比 RSA 和传统 ECDSA 更快。

2. 核心原理

密钥生成

- 私钥:32 字节随机种子(通常来自 CSPRNG)。

- 公钥:通过私钥计算

A = d * B,其中B是曲线基点,d是私钥哈希。

签名

- 计算

r = Hash(私钥 + 消息)。 - 生成临时点

R = r * B。 - 计算

s = (r + Hash(R || A || 消息) * d) mod L。 - 输出

(R, s)(共 64 字节)。

验证

检查:

s * B == R + Hash(R || A || 消息) * A。

3. Rust 实现示例

以下代码演示如何在 Rust 中使用 Ed25519 为代币交易签名。

步骤 1:添加依赖

# Cargo.toml

[dependencies]

ed25519-dalek = { version = "2.0.0", features = ["rand_core"] }

rand_core = { version = "0.6.4", features = ["getrandom"] }

步骤 2:生成密钥对

#![allow(unused)] fn main() { use ed25519_dalek::{Keypair, Signer, Verifier, Signature}; use rand_core::OsRng; fn generate_keypair() -> Keypair { // 从安全随机源生成密钥对 let mut csprng = OsRng; Keypair::generate(&mut csprng) } }

步骤 3:签名与验证

#![allow(unused)] fn main() { fn sign_and_verify() { // 1. 生成密钥对 let keypair = generate_keypair(); let public_key = keypair.public(); // 2. 签名一条消息(例如代币交易) let message = b"Transfer 100 tokens to Alice"; let signature: Signature = keypair.sign(message); // 3. 验证签名 match public_key.verify(message, &signature) { Ok(_) => println!("Signature is valid!"), Err(_) => println!("Signature is invalid!"), } } }

步骤 4:完整代币交易示例

struct TokenTransaction { sender: String, receiver: String, amount: u64, } impl TokenTransaction { fn sign(&self, keypair: &Keypair) -> Signature { let message = serde_json::to_vec(self).unwrap(); keypair.sign(&message) } fn verify(&self, signature: &Signature, public_key: &PublicKey) -> bool { let message = serde_json::to_vec(self).unwrap(); public_key.verify(&message, signature).is_ok() } } fn main() { let keypair = generate_keypair(); let transaction = TokenTransaction { sender: "Bob".to_string(), receiver: "Alice".to_string(), amount: 100, }; // 签名交易 let signature = transaction.sign(&keypair); // 验证交易 let is_valid = transaction.verify(&signature, &keypair.public_key()); println!("Transaction valid? {}", is_valid); }

4. 为什么选择 Ed25519?

- 安全性

- 无随机数风险(对比 ECDSA)。

- 抗侧信道攻击(恒定时间操作)。

- 性能

- 签名速度比 RSA-2048 快约 10 倍。

- 签名验证速度极快。

- 标准化

- 被 IETF (RFC 8032)、OpenSSH、Solana 等广泛采用。

5. 注意事项

- 私钥管理:必须安全存储种子(32 字节)。

- 库的选择:优先使用审计过的库(如

ed25519-dalek)。 - 不要自行实现密码学:直接使用标准库。

RSA

区块链技术概览

引导

✔️❌ 标志文章更新时刻仍在维护

市值

区块链开发部署工具

✔️Hardhat

- 从开发到部署全覆盖的工具,内置 hardhat node 等内部测试链

- 工具全面但相对比较臃肿,类似 hardhat-ethers、hardhat-viem 等包均涉及

- 基础的开发部署命令例如 hardhat deploy 等已经具备部署能力

- 支持 TypeScript,提供完整的开发环境

- 丰富的插件生态系统

✔️Foundry

- 后起之秀,工具集健全,目前没有过于臃肿

- 使用 Rust 编写,性能优异

- 内置测试框架,支持快速开发

- 支持直接使用 Solidity 编写测试

- 提供完整的部署和验证工具链

✔️Truffle

- 成熟的开发框架,历史悠久

- 提供完整的开发、测试和部署工具链

- 支持多种网络配置

- 内置控制台和调试工具

- 丰富的插件系统

Solana 开发工具

✔️Anchor

- Solana 智能合约开发框架

- 使用 Rust 编写合约

- 提供完整的开发工具链

- 支持 TypeScript/JavaScript 客户端

- 内置测试框架和部署工具

✔️Solana Program Library (SPL)

- Solana 标准程序库

- 包含代币、NFT 等标准实现

- 提供完整的文档和示例

- 活跃的社区维护

- 支持多种代币标准

✔️Seahorse

- Python 开发 Solana 智能合约

- 简化开发流程

- 适合 Python 开发者

- 提供完整的开发工具

- 活跃的社区支持

区块链交互工具

❌web3.js

- 当前使用量最高的交互工具,大量的开发项目使用此库进行开发

- doc 文档丰富且全面,指引较多

- 截止 2025.3.4 号已经停更,详情可见ChainSafe

- 建议新项目迁移到 ethers.js 或 viem

✔️ethers.js

- 截止 2025.3.25 仍在更新的交互工具

- doc 内容偏应用,没有太多说明

- 提供完整的 TypeScript 支持

- 内置多种实用工具和辅助函数

- 活跃的社区支持

✔️viem

- 截止 2025.3.25 仍在更新的交互工具

- 性能优异,相关对比测试

- TypeScript 优先,提供完整的类型支持

- 模块化设计,可按需引入

- 支持多种链和网络

Solana 交互工具

✔️web3.js

- Solana 官方 JavaScript API

- 提供完整的 TypeScript 支持

- 支持所有 Solana 功能

- 活跃的社区维护

- 丰富的文档和示例

✔️Phantom Wallet

- 流行的 Solana 钱包

- 提供完整的 SDK

- 支持多种功能

- 良好的用户体验

- 活跃的社区支持

智能合约开发工具

✔️OpenZeppelin

- 提供标准化的智能合约库

- 包含 ERC20、ERC721 等标准实现

- 提供完整的安全审计

- 活跃的社区维护

- 丰富的文档和示例

✔️Remix IDE

- 浏览器-based 开发环境

- 支持在线编译和部署

- 内置调试工具

- 支持插件扩展

- 适合快速原型开发

测试工具

❌Ganache

- 已经停更的本地测试工具,用于模拟以太坊节点交互。

✔️Waffle

- 基于 ethers.js 的测试框架

- 支持 TypeScript

- 提供丰富的断言库

- 支持快照测试

- 与 Hardhat 完美集成

✔️Chai

- 流行的断言库

- 支持多种断言风格

- 丰富的插件系统

- 良好的文档支持

- 广泛用于智能合约测试

监控和分析工具

✔️Etherscan

- 区块链浏览器

- 合约验证服务

- API 接口支持

- 丰富的分析工具

- 支持多链

✔️Tenderly

- 实时监控和告警

- 交易模拟和调试

- 智能合约分析

- 支持多链

- 提供 API 服务

Solana 监控工具

✔️Solana Explorer

- Solana 区块链浏览器

- 实时交易监控

- 账户分析工具

- 程序部署验证

- 支持测试网和主网

✔️Solscan

- 专业的 Solana 分析工具

- 提供详细的链上数据

- 支持代币和 NFT 追踪

- 提供 API 服务

- 支持多语言

安全工具

✔️Slither

- 静态分析工具

- 支持多种漏洞检测

- 提供详细的报告

- 支持自定义规则

- 活跃的社区维护

✔️Mythril

- 智能合约安全分析工具

- 支持符号执行

- 提供漏洞检测

- 支持多种输出格式

- 持续更新维护

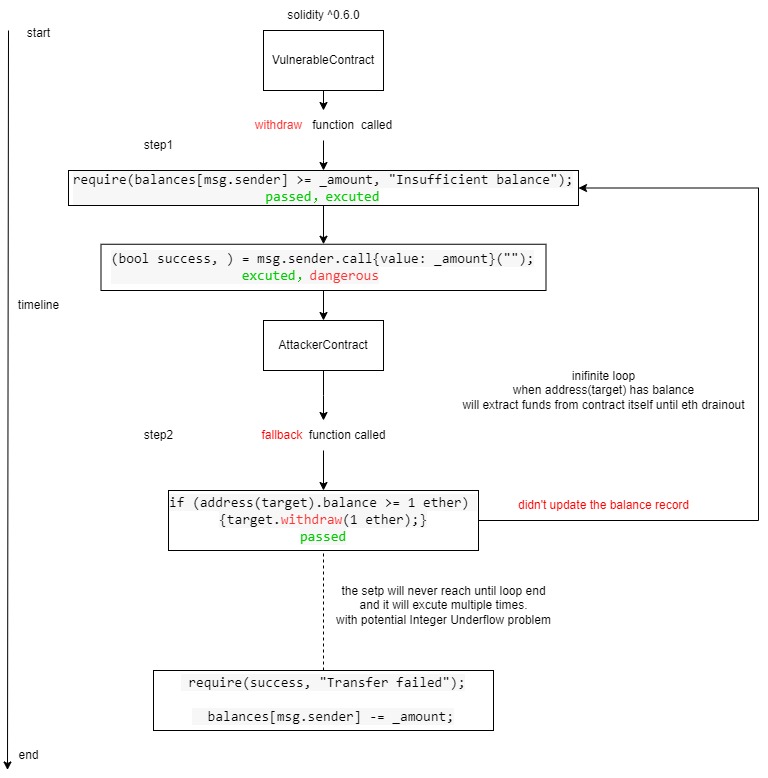

Security and Risks

This page is a placeholder for security- and risk-related content in blockchain systems. Content to be added.

Ethereum

概览(官方介绍)

什么是以太坊?

以太坊是一个由世界各地的计算机组成的网络,遵循一套称为以太坊协议的规则。以太坊网络提供了一个基础,任何人都可以在上面构建和使用社区、应用程序、组织和数字资产。

谁在运行以太坊?

以太坊不受任何特定实体控制。只要计算机运行遵循以太坊协议的软件,相互连接,并为以太坊区块链添加区块,以太坊就会存在。其中每一台计算机都被称为节点。任何人都可以运行节点,但必须要质押以太币(以太坊的原生代币)才能参与保护网络安全的工作。任何人无需许可,都可以用 32 个以太币参与质押。 甚至以太坊的源代码也不是由单个实体生成的。任何人都可以建议更改协议并讨论升级。有一些以太坊协议的实现是由独立组织用多种编程语言完成的,它们通常建立在开放的基础上并鼓励来自社区的贡献。

以太坊基础

以太坊(Ethereum)是继比特币之后最具影响力的区块链平台,被誉为"区块链2.0"。不同于比特币专注于数字货币,以太坊创建了一个去中心化的全球计算机,使开发者能够构建各种应用程序。以下收集了以太坊的基础知识,包括其技术架构、核心概念、重要协议升级及其广泛的应用生态系统。

以太坊的核心概念

1. 智能合约

智能合约是以太坊最具革命性的特性,它们是部署在区块链上的自动执行程序。

- 定义:智能合约是一套以数字形式定义的承诺,包含了合约参与方可以执行的协议。

- 特点:自动执行、不可篡改、透明公开

- 语言:主要使用Solidity语言编写,也支持Vyper、Yul等

- 执行环境:以太坊虚拟机(EVM)

智能合约的代码示例(Solidity):

// 简单的代币合约示例

pragma solidity ^0.8.0;

contract SimpleToken {

string public name;

string public symbol;

uint256 public totalSupply;

mapping(address => uint256) public balanceOf;

event Transfer(address indexed from, address indexed to, uint256 value);

constructor(string memory _name, string memory _symbol, uint256 _totalSupply) {

name = _name;

symbol = _symbol;

totalSupply = _totalSupply;

balanceOf[msg.sender] = _totalSupply;

}

function transfer(address _to, uint256 _value) public returns (bool success) {

require(balanceOf[msg.sender] >= _value, "Insufficient balance");

balanceOf[msg.sender] -= _value;

balanceOf[_to] += _value;

emit Transfer(msg.sender, _to, _value);

return true;

}

}

2. 以太坊虚拟机(EVM)

EVM是以太坊的核心组件,负责处理智能合约的执行。

- 特点:图灵完备,可以运行任何计算程序

- 操作:基于操作码(Opcodes)执行指令

- 隔离性:合约在沙箱环境中运行,确保安全性

- 状态:维护全球状态树,记录所有账户状态

3. 账户系统

以太坊有两种类型的账户:

-

外部账户(EOA):

- 由用户控制(通过私钥)

- 可以发送交易

- 没有关联代码

-

合约账户:

- 由代码控制

- 只能响应收到的交易

- 存储合约代码和状态

4. 燃料(Gas)机制

Gas是以太坊上计算资源使用的度量单位:

- 目的:防止资源滥用和无限循环攻击

- 计算方式:每个操作都有特定的Gas成本

- Gas价格:以Gwei(10^-9 ETH)为单位,由交易发送者设定

- Gas上限:交易中指定的最大Gas使用量

- EIP-1559:2021年8月伦敦升级引入的新费用模型,引入基础费用和小费机制

5. 以太币(Ether)

以太币是以太坊网络的原生加密货币:

- 符号:ETH

- 功能:支付交易费用、智能合约操作费用、价值存储

- 单位:Wei(最小单位)、Gwei、Finney、Ether等

- 发行:初始通过ICO发行,后续通过区块奖励产生

以太坊的技术架构

1. 区块结构

以太坊区块包含以下主要组件:

- 区块头:包含前一个区块哈希、时间戳、挖矿信息等

- 交易列表:区块中包含的所有交易

- 叔块信息:包含近期的孤块信息(针对PoW时代)

- 状态树:记录所有账户的当前状态

- 收据树:记录交易执行的结果和日志

2. 共识机制演进

以太坊的共识机制经历了重大变革:

-

工作量证明(PoW):

- 初始共识机制

- 算法:Ethash,设计为ASIC抗性

- 区块时间:约15秒

-

权益证明(PoS):

- 通过合并(The Merge)升级实现

- 验证者需质押至少32 ETH

- 能源效率提高99.95%

- 区块时间:约12秒

3. 分片(Sharding)

分片是以太坊可扩展性路线图的关键部分:

- 目标:并行处理交易,提高网络吞吐量

- 设计:将网络分成多个分片,每个分片处理一部分交易

- 状态:目前在路线图中,计划在合并后实施

- 挑战:跨分片通信、数据可用性、安全性保证

以太坊的重要协议升级

以太坊通过硬分叉实现协议升级,主要包括:

1. 前沿(Frontier) - 2015年7月

- 以太坊主网的初始版本

- 引入基本功能:智能合约、交易处理等

2. 家园(Homestead) - 2016年3月

- 第一个稳定版本

- 改进了安全性和交易处理

3. 拜占庭(Byzantium) - 2017年10月

- 元都(Metropolis)升级的第一阶段

- 增加了零知识证明等隐私功能

- 减少了挖矿奖励

4. 君士坦丁堡(Constantinople) - 2019年2月

- 优化了Gas成本

- 延迟了难度炸弹

- 为权益证明过渡做准备

5. 伊斯坦布尔(Istanbul) - 2019年12月

- 提高了Gas使用效率

- 改进了Layer 2解决方案的兼容性

6. 信标链(Beacon Chain) - 2020年12月

- 启动了PoS链

- 为"合并"奠定基础

7. 伦敦(London) - 2021年8月

- 引入EIP-1559费用机制

- 部分ETH燃烧,引入通缩机制

8. 合并(The Merge) - 2022年9月

- 将执行层(原PoW链)与共识层(信标链)结合

- 从PoW完全过渡到PoS

- 减少了约99.95%的能源消耗

9. 上海(Shanghai)/卡佩拉(Capella) - 2023年4月

- 允许质押ETH的提取

- 提高了EVM效率

10. Cancun/Deneb - 2024年

- 引入Proto-Danksharding (EIP-4844)

- 降低了Layer 2的成本

- 改进了EVM功能

以太坊的应用生态系统

1. 代币标准

以太坊上有多种代币标准,最著名的包括:

- ERC-20:同质化代币标准,用于加密货币和实用代币

- ERC-721:非同质化代币(NFT)标准,每个代币都是独特的

- ERC-1155:多代币标准,支持同质化和非同质化代币

- ERC-4626:代币化资金库标准,用于收益聚合

2. DeFi(去中心化金融)

以太坊是DeFi的主要平台,包括:

- 去中心化交易所:Uniswap、Curve、SushiSwap

- 借贷协议:Aave、Compound、MakerDAO

- 衍生品:Synthetix、dYdX

- 保险:Nexus Mutual、InsurAce

- 收益聚合:Yearn Finance、Convex

3. NFT(非同质化代币)

NFT在以太坊上实现了突破性增长:

- 数字艺术:Art Blocks、SuperRare

- 收藏品:CryptoPunks、Bored Ape Yacht Club

- 游戏资产:Axie Infinity、Gods Unchained

- 虚拟土地:Decentraland、The Sandbox

- 社交代币:ENS域名、POAP

4. Layer 2扩展解决方案

为解决以太坊可扩展性问题,出现了多种Layer 2解决方案:

- Rollups:

- Optimistic Rollups:Optimism、Arbitrum

- ZK-Rollups:zkSync、StarkNet

- 状态通道:提供链下交易确认

- 侧链:Polygon PoS、Gnosis Chain

5. 去中心化自治组织(DAO)

以太坊上的DAO实现了去中心化治理:

- 协议治理:Uniswap、Compound

- 投资DAO:BitDAO、Flamingo

- 服务DAO:Gitcoin、RaidGuild

- 社交DAO:Friends With Benefits、PleasrDAO

以太坊开发工具与框架

1. 开发环境

- Remix:基于网页的IDE,适合入门

- Hardhat:JavaScript开发环境

- Truffle Suite:完整开发框架

- Foundry:Rust编写的快速开发工具

2. 库与API

- web3.js:JavaScript库

- ethers.js:替代web3.js的现代库

- Infura/Alchemy:节点服务提供商

- The Graph:区块链数据索引

3. 测试网络

- Sepolia:当前主要测试网

- Goerli:即将淘汰的测试网

- Holesky:新的权益证明测试网

以太坊的挑战与未来

1. 可扩展性

尽管有了Layer 2解决方案,以太坊的基础层仍面临吞吐量限制:

- 交易处理能力:主网约15-30 TPS

- 高Gas费:在网络拥堵时期可能非常昂贵

- 解决方案:分片、数据可用性采样(DAS)、Layer 2优化

2. 监管与合规

随着以太坊应用的增长,监管挑战也随之增加:

- 证券法规:某些代币可能被视为证券

- KYC/AML:DeFi协议的合规要求

- 跨境监管:不同国家的监管差异

3. 去中心化与安全性

保持去中心化同时确保安全性是持续挑战:

- 验证者集中化:大型质押池的影响

- MEV(最大可提取价值):交易排序的公平性问题

- 智能合约漏洞:代码审计和安全实践的重要性

4. 路线图:迈向以太坊2.0

以太坊的未来发展计划包括:

- Proto-Danksharding:通过blob交易提高数据可用性

- 全分片:实现完整的数据和执行分片

- 单一时隙确定性:减少确认时间

- EVM改进:持续优化虚拟机性能

- 状态过期:解决状态膨胀问题

Ethers

Ethers.js 通过私钥还原公钥

一、什么是私钥和公钥?

在以太坊和其他区块链平台中,私钥是一个源信息,用于命令链上账户进行操作。公钥则是从私钥中运算出的,用于验证操作的合法性和完整性。

二、安装 ethers.js

在实现私钥还原公钥之前,需要先安装 ethers.js:

npm install ethers

三、使用 ethers.js 运算公钥

以下是通过 ethers.js 将私钥转换为公钥的完整代码:

const { Wallet } = require('ethers');

// 私钥(确保保密!)

const privateKey = "0x<64-hex-characters>";

// 从私钥生成钥包实例

const wallet = new Wallet(privateKey);

// 获取公钥

const publicKey = wallet.publicKey;

console.log("私钥:", privateKey);

console.log("公钥:", publicKey);

输出格式

- 私钥:输入值,64 个十六进制字符,前缀为

0x。 - 公钥:未压缩格式,65 字节(520 bits),以

0x04开头表示未压缩格式,随后为 X、Y 坐标。

示例输出

私钥: 0x1e99423a701fcf82f4888e3e23b6c1840ad48d360bb8bc1239e0c7ff8ecf743d

公钥: 0x04bfcab4e67d19d84cf2047269de360f3e51b50fa5c45594f5365ff3c7ec8f3f482c909de42ccadf81a913e51e535fc327fced47adf968f2bf4bfdbc5f8862bb2d

四、运算原理解析

使用的曲线:secp256k1

ethers.js 使用了 secp256k1 椭圆曲线,这是比特币和以太坊等区块链系统使用的标准曲线。secp256k1 定义了一个椭圆曲线方程:y^2 = x^3 + 7,并基于此定义了一个基点 G。公钥是通过私钥对基点 G 进行椭圆曲线点乘计算得出的。这个过程确保了私钥与公钥之间的唯一性和安全性,同时公钥可以公开用于验证签名的合法性。

ERC

ERC 是 Ethereum Request for Comments(以太坊请求评论)的缩写。它是以太坊社区定义的一系列智能合约标准。这些标准为以太坊上的智能合约开发提供了规则和指南,确保不同开发者创建的合约能够相互交互和兼容。

ERC 的主要作用

互操作性

在以太坊生态系统中 ,不同的开发者可能会创建各种各样的智能合约。ERC 标准允许这些合约以一种统一的方式进行交互。例如,在去中心化金融(DeFi)领域,有许多不同的应用程序,如借贷平台、去中心化交易所等。ERC - 20 标准的存在使得各种通证能够在这些不同的平台之间方便地流通和交易。

标准化开发

为开发者提供了清晰的开发指南。以 ERC - 721 为例,这个标准专门用于非同质化通证(NFT)。它规定了 NFT 合约必须实现的一些基本方法,如balanceOf(查询某个地址拥有的 NFT 数量)、ownerOf(查询某个 NFT 的所有者)和transferFrom(转移 NFT 的所有权)等。这使得开发者在创建 NFT 项目时能够遵循一套既定的规则,减少开发过程中的混乱,并确保所开发的 NFT 能够被市场上的各种钱包和应用程序所支持。

常见的 ERC 标准

ERC - 20

这是最著名的 ERC 标准之一,主要用于创建可互换的数字资产,也就是同质化通证。在以太坊上发行的大多数加密货币(如以太坊本身之外的许多山寨币)都遵循 ERC - 20 标准。它定义了一套接口,包括totalSupply(总供应量)、balanceOf(账户余额)、transfer(转账)、transferFrom(授权转账)、approve(授权)等方法。

ERC - 721:

专为非同质化通证(NFT)设计。与 ERC - 20 不同,ERC - 721 中的每个通证都是独一无二的,不能与其他通证互换。NFT 在数字艺术、游戏道具、虚拟房地产等领域有广泛的应用。通过 ERC - 721 标准,这些独特的资产可以在以太坊区块链上安全地创建、拥有和交易。

ERC - 1155:

这是一种多令牌标准,它结合了 ERC - 20 和 ERC - 721 的特点。ERC - 1155 允许在一个智能合约中同时管理多种类型的通证,包括同质化和非同质化通证。这种标准在游戏开发等场景中特别有用,因为游戏中可能同时存在可互换的游戏货币和独一无二的游戏道具。

概念

ERC-20 标准的 ABI 是一组函数和事件定义,用于在以太坊上实现可互换的代币标准。ERC-20 代币标准由以太坊社区提出,定义了一组基础接口和功能,如余额查询、转账和授权等。

目前以太坊等支持evm的链上最活跃的合约标准,大量的加密货币依赖此合约进行交易。

ERC-20 ABI 说明

-

Functions:

totalSupply:返回代币的总供应量。balanceOf:查询指定地址的余额。transfer:从发送者地址向指定地址发送代币。approve:批准某个地址可以花费指定数量的代币。allowance:查询某个地址对另一个地址授权的代币数量。transferFrom:从指定地址向另一个地址转移代币(需要先批准)。

-

Events:

Transfer:代币转移事件,记录从一个地址向另一个地址转移的情况。Approval:授权事件,记录某个地址被授权花费代币。

-

Metadata Functions(非强制但通常包含):

name:代币的名称。symbol:代币的符号。decimals:代币的小数位数,通常是 18。

ERC-20 标准 ABI

以下是 ERC-20 标准 ABI,用于与符合 ERC-20 标准的合约进行交互:

[

{

"constant": true,

"inputs": [{"name": "_owner", "type": "address"}],

"name": "balanceOf",

"outputs": [{"name": "balance", "type": "uint256"}],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": false,

"inputs": [

{"name": "_to", "type": "address"},

{"name": "_value", "type": "uint256"}

],

"name": "transfer",

"outputs": [{"name": "", "type": "bool"}],

"payable": false,

"stateMutability": "nonpayable",

"type": "function"

},

{

"constant": false,

"inputs": [

{"name": "_spender", "type": "address"},

{"name": "_value", "type": "uint256"}

],

"name": "approve",

"outputs": [{"name": "", "type": "bool"}],

"payable": false,

"stateMutability": "nonpayable",

"type": "function"

},

{

"constant": true,

"inputs": [

{"name": "_owner", "type": "address"},

{"name": "_spender", "type": "address"}

],

"name": "allowance",

"outputs": [{"name": "", "type": "uint256"}],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": false,

"inputs": [

{"name": "_from", "type": "address"},

{"name": "_to", "type": "address"},

{"name": "_value", "type": "uint256"}

],

"name": "transferFrom",

"outputs": [{"name": "", "type": "bool"}],

"payable": false,

"stateMutability": "nonpayable",

"type": "function"

},

{

"inputs": [],

"payable": false,

"stateMutability": "nonpayable",

"type": "constructor"

},

{

"anonymous": false,

"inputs": [

{"indexed": true, "name": "owner", "type": "address"},

{"indexed": true, "name": "spender", "type": "address"},

{"indexed": false, "name": "value", "type": "uint256"}

],

"name": "Approval",

"type": "event"

},

{

"anonymous": false,

"inputs": [

{"indexed": true, "name": "from", "type": "address"},

{"indexed": true, "name": "to", "type": "address"},

{"indexed": false, "name": "value", "type": "uint256"}

],

"name": "Transfer",

"type": "event"

},

{

"constant": true,

"inputs": [],

"name": "totalSupply",

"outputs": [{"name": "", "type": "uint256"}],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": true,

"inputs": [],

"name": "name",

"outputs": [{"name": "", "type": "string"}],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": true,

"inputs": [],

"name": "symbol",

"outputs": [{"name": "", "type": "string"}],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": true,

"inputs": [],

"name": "decimals",

"outputs": [{"name": "", "type": "uint8"}],

"payable": false,

"stateMutability": "view",

"type": "function"

}

]

如何使用 ERC-20 ABI

使用上面的 ABI 和 web3.js 或 ethers.js 库,可以轻松与符合 ERC-20 标准的智能合约交互。

使用 ethers.js 示例:

使用 web3.js 示例:

const Web3 = require('web3');

const web3 = new Web3('https://mainnet.infura.io/v3/YOUR_INFURA_PROJECT_ID');

const erc20ABI = [/* 这里粘贴上面的 ERC-20 ABI */];

const contractAddress = '0xTokenContractAddress'; // 替换为 ERC-20 代币合约地址

const erc20Contract = new web3.eth.Contract(erc20ABI, contractAddress);

erc20Contract.methods.balanceOf('0xYourAddress').call()

.then(balance => console.log(`Token Balance: ${balance}`));

总结

ERC-20 标准 ABI 包含了代币的核心功能,如代币转移、余额查询和授权操作。通过使用此标准的 ABI,你可以与任何 ERC-20 兼容的合约进行交互。

如何调用任意ERC20合约

详见github项目BlockChain_InteractTools

ERC712

在以太坊生态系统中,链下签名是一种重要的优化手段,它允许用户在不直接发送交易到区块链的情况下签署消息,从而节省 Gas 费用并提高效率。然而,在 ERC-712 标准出现之前,各种应用在实现链下签名时缺乏统一的规范,导致用户体验不佳,并且存在潜在的安全风险。ERC-712 的诞生正是为了解决这些问题,它为结构化数据的链下签名提供了一个明确且标准化的框架。

ERC-712 的核心目标:提升用户体验和安全性

ERC-712 的主要目标在于:

- 提升用户可读性: 在用户签署消息之前,能够以人类可读的方式清晰地展示他们正在签署的内容,避免盲签带来的风险。

- 增强安全性: 通过引入类型化的结构化数据和明确的签名域,降低恶意应用伪造签名的可能性。

- 实现标准化: 为不同的去中心化应用(DApps)提供一个统一的链下签名实现标准,方便钱包等客户端进行集成和支持,提升用户在不同应用间的体验一致性。

ERC-712 的关键概念

ERC-712 引入了几个关键概念,共同构成了其标准化框架:

-

结构化数据 (Structured Data): ERC-712 允许对复杂的数据结构进行签名,而不仅仅是简单的哈希值。这些数据结构通过定义明确的类型和字段来描述。

-

类型哈希 (Type Hash): 对于每种结构化数据类型,ERC-712 定义了一种计算其唯一哈希值的方法。这个类型哈希包含了类型的名称和所有字段的名称及类型。

-

域分隔符 (Domain Separator): 为了防止签名在不同的应用或上下文中被重用,ERC-712 引入了域分隔符。域分隔符是一个包含特定于应用或协议信息的结构化数据,例如合约地址、链 ID 和协议名称。对消息进行签名时,域分隔符的哈希会与消息内容的哈希一起被考虑。

-

主类型 (Primary Type): 在一个复杂的结构化数据中,会指定一个“主类型”,签名实际上是对这个主类型及其依赖的所有类型进行哈希计算的结果进行签名。

-

编码方案 (Encoding Scheme): ERC-712 定义了一套标准的编码规则,用于将结构化数据、类型哈希和域分隔符编码成最终的签名消息。

ERC-712 的工作流程

当一个 DApp 需要用户进行链下签名时,其工作流程通常如下:

-

构建结构化数据: DApp 根据需要签署的信息构建一个符合 ERC-712 规范的结构化数据对象。这个对象包含明确的类型定义和具体的数据字段。

-

生成类型哈希: DApp 根据结构化数据的类型定义,按照 ERC-712 的规则计算出类型哈希。

-

构建域分隔符: DApp 构建一个包含其应用特定信息的域分隔符结构,并计算其哈希值。

-

编码签名消息: DApp 将域分隔符哈希、主类型哈希以及编码后的结构化数据按照 ERC-712 定义的规则组合成最终的待签名消息。

-

请求用户签名: DApp 将编码后的消息发送给用户的钱包。

-

钱包处理和展示: 遵循 ERC-712 标准的钱包能够解析接收到的消息,根据类型定义和数据字段以人类可读的方式向用户展示他们正在签署的内容,包括应用名称、链 ID 以及具体的交易或操作细节。

-

用户签名: 用户在确认信息无误后,使用其私钥对编码后的消息进行签名,生成 ECDSA 签名(v, r, s)。

-

链上验证: DApp 将用户的签名、原始的结构化数据和签名者的地址发送到智能合约。智能合约可以使用

ecrecover函数结合 ERC-712 的编码规则,重新计算出原始消息的哈希,并验证签名是否由声明的签名者生成。

ERC-712 的优势

- 显著提升用户体验: 用户在签名之前可以清晰地了解他们正在授权的操作,降低了误操作的风险。

- 增强安全性: 类型化的数据和域分隔符有效防止了签名被恶意重用或伪造。

- 促进生态系统标准化: 统一的标准使得钱包和 DApp 之间的集成更加 সহজ,提升了整个以太坊生态系统的互操作性。

- 降低开发复杂性: 开发者可以依赖标准的库和工具来实现 ERC-712 签名,减少了自定义实现的复杂性和潜在错误。

总结

ERC-712 不仅仅是一个技术标准,更是提升以太坊用户体验和安全性的重要基石。通过引入结构化数据签名、类型哈希和域分隔符等关键概念,ERC-712 为链下签名提供了一个清晰、安全且标准化的解决方案。随着以太坊生态的不断发展,ERC-712 的重要性将愈发凸显,它将继续赋能开发者构建更加安全和用户友好的去中心化应用。理解和支持 ERC-712 对于所有参与以太坊生态的开发者、用户和钱包提供商来说都至关重要。

ERC721概念

NFT的标准实现,作为同质化代币的合约标准。具有存储元数据及拥有者,以及对应的查询、管理功能。

主要功能

-

事件 (Events):

Transfer:当 NFT 被转移时触发。Approval:当某个地址被授权管理 NFT 时触发。ApprovalForAll:当某个地址被授权管理所有 NFT 时触发。

-

方法 (Functions):

balanceOf(address owner):查询某地址拥有的 NFT 数量。ownerOf(uint256 tokenId):查询某个 NFT 的持有者。approve(address to, uint256 tokenId):授权某个地址管理指定的 NFT。setApprovalForAll(address operator, bool approved):批量授权某个地址管理所有 NFT。getApproved(uint256 tokenId):查询某个 NFT 被授权的地址。isApprovedForAll(address owner, address operator):查询某个地址是否被批量授权。safeTransferFrom(address from, address to, uint256 tokenId):安全转移 NFT。tokenURI(uint256 tokenId):查询 NFT 的元数据 URI。

下面是一个标准的 ERC-721 代币合约的 ABI(Application Binary Interface),基于 OpenZeppelin 的实现:

[

{

"anonymous": false,

"inputs": [

{

"indexed": true,

"internalType": "address",

"name": "from",

"type": "address"

},

{

"indexed": true,

"internalType": "address",

"name": "to",

"type": "address"

},

{

"indexed": true,

"internalType": "uint256",

"name": "tokenId",

"type": "uint256"

}

],

"name": "Transfer",

"type": "event"

},

{

"anonymous": false,

"inputs": [

{

"indexed": true,

"internalType": "address",

"name": "owner",

"type": "address"

},

{

"indexed": true,

"internalType": "address",

"name": "approved",

"type": "address"

},

{

"indexed": true,

"internalType": "uint256",

"name": "tokenId",

"type": "uint256"

}

],

"name": "Approval",

"type": "event"

},

{

"anonymous": false,

"inputs": [

{

"indexed": true,

"internalType": "address",

"name": "owner",

"type": "address"

},

{

"indexed": true,

"internalType": "address",

"name": "operator",

"type": "address"

},

{

"indexed": false,

"internalType": "bool",

"name": "approved",

"type": "bool"

}

],

"name": "ApprovalForAll",

"type": "event"

},

{

"inputs": [

{

"internalType": "address",

"name": "to",

"type": "address"

},

{

"internalType": "uint256",

"name": "tokenId",

"type": "uint256"

}

],

"name": "approve",

"outputs": [],

"stateMutability": "nonpayable",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "owner",

"type": "address"

}

],

"name": "balanceOf",

"outputs": [

{

"internalType": "uint256",

"name": "",

"type": "uint256"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [

{

"internalType": "uint256",

"name": "tokenId",

"type": "uint256"

}

],

"name": "getApproved",

"outputs": [

{

"internalType": "address",

"name": "",

"type": "address"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "owner",

"type": "address"

},

{

"internalType": "address",

"name": "operator",

"type": "address"

}

],

"name": "isApprovedForAll",

"outputs": [

{

"internalType": "bool",

"name": "",

"type": "bool"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "from",

"type": "address"

},

{

"internalType": "address",

"name": "to",

"type": "address"

},

{

"internalType": "uint256",

"name": "tokenId",

"type": "uint256"

}

],

"name": "safeTransferFrom",

"outputs": [],

"stateMutability": "nonpayable",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "from",

"type": "address"

},

{

"internalType": "address",

"name": "to",

"type": "address"

},

{

"internalType": "uint256",

"name": "tokenId",

"type": "uint256"

},

{

"internalType": "bytes",

"name": "_data",

"type": "bytes"

}

],

"name": "safeTransferFrom",

"outputs": [],

"stateMutability": "nonpayable",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "operator",

"type": "address"

},

{

"internalType": "bool",

"name": "approved",

"type": "bool"

}

],

"name": "setApprovalForAll",

"outputs": [],

"stateMutability": "nonpayable",

"type": "function"

},

{

"inputs": [

{

"internalType": "bytes4",

"name": "interfaceId",

"type": "bytes4"

}

],

"name": "supportsInterface",

"outputs": [

{

"internalType": "bool",

"name": "",

"type": "bool"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [

{

"internalType": "uint256",

"name": "tokenId",

"type": "uint256"

}

],

"name": "ownerOf",

"outputs": [

{

"internalType": "address",

"name": "",

"type": "address"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "name",

"outputs": [

{

"internalType": "string",

"name": "",

"type": "string"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [],

"name": "symbol",

"outputs": [

{

"internalType": "string",

"name": "",

"type": "string"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [

{

"internalType": "uint256",

"name": "tokenId",

"type": "uint256"

}

],

"name": "tokenURI",

"outputs": [

{

"internalType": "string",

"name": "",

"type": "string"

}

],

"stateMutability": "view",

"type": "function"

}

]

ERC-725: 区块链身份标准

摘要

ERC-725 是一个为基于区块链的身份(或任何事物)建立的通用、可扩展的标准。它允许智能合约拥有一个去中心化的身份,并通过一个统一的接口来管理与之关联的数据和权限。这个标准主要分为两部分:ERC-725X (执行) 和 ERC-725Y (数据)。

1. 背景:为什么需要链上身份?

在以太坊上,EOA(外部拥有账户)和合约账户本身不包含任何元数据。一个地址 0x... 无法告诉我们它代表的是一个人、一个组织、一台设备还是一个 DApp。为了解决这个问题,我们需要一个标准化的方式来为账户附加信息和管理权限,这就是 ERC-725 的目标。

ERC-725 旨在为任何地址(无论是合约还是未来的账户抽象钱包)创建一个可编程的、自我主权的身份。

2. 核心概念

ERC-725 身份由两个核心部分组成,它们通常在同一个智能合约中实现。

ERC-725Y: 通用键值数据存储

ERC-725Y 提出了一种使用键值对来存储身份数据的标准。这使得身份信息变得非常灵活和可扩展。

- 数据键 (Data Key):是一个

bytes32值,用于标识一段特定的数据。为了避免冲突并实现互操作性,社区定义了一个通用标准 LSP2 (LUKSO Standard Proposal 2) 来规范如何生成这些键。例如,一个名为UserProfile的 JSON 对象的键可以被标准化地哈希为一个bytes32值。 - 数据值 (Data Value):是与键关联的

bytes数据。它可以是任何信息,例如个人资料、认证声明、其他资产的地址等。

通过 getData(bytes32 key) 和 setData(bytes32 key, bytes value) 这两个核心函数,任何外部应用都可以以标准化的方式读取或写入(如果权限允许)一个身份的数据。

示例: 一个用户的身份合约可以存储以下信息:

keccak256("LSP3Profile")->0x...(指向一个包含个人资料 JSON 文件的 IPFS CID)keccak256("LSP5ReceivedAssets[]")->[0x..., 0x...](该身份拥有的资产列表)

ERC-725X: 通用执行

ERC-725X 允许身份的所有者或授权的密钥,通过该身份合约执行任意操作。

execute(uint256 operationType, address target, uint256 value, bytes calldata):这是 ERC-725X 的核心函数。它允许身份合约与其他智能合约进行交互。operationType: 定义了操作类型,如CALL,CREATE,STATICCALL等。target: 目标合约地址。value: 发送的 ETH 数量。calldata: 要执行的函数调用数据。

这种设计将 “谁可以执行” (权限管理) 和 “可以执行什么” (具体操作) 分离开来。身份合约的所有者可以授予不同的密钥不同的权限,例如:

- 一个密钥只能用于在社交媒体 DApp 上发帖 (

execute调用该 DApp 的post函数)。 - 另一个密钥可以转移资产 (

execute调用 ERC20 的transfer函数)。 - 主密钥拥有管理其他密钥的最高权限。

3. 权限管理与密钥

ERC-725 的强大之处在于其灵活的权限管理系统。身份的所有权不是由单个私钥(像 EOA 那样)控制,而是由一组具有不同权限的密钥来管理。

- 密钥 (Key):可以是 EOA 地址或另一个合约地址。

- 目的 (Purpose):每个密钥都被分配一个或多个“目的”,定义了它能做什么。例如:

PURPOSE_MANAGEMENT: 管理密钥和权限。PURPOSE_EXECUTION: 执行交易。PURPOSE_ENCRYPTION: 用于加密数据。

- 方案 (Scheme):定义了签名的类型,例如

ECDSA(用于 EOA) 或EIP1271(用于合约签名)。

这种模型被称为 “元交易 (Meta-Transactions)” 的一种实现,因为交易的验证逻辑(签名和权限检查)是在合约内部处理的,而不是由以太坊协议本身处理。

4. 用例

ERC-725 的应用场景非常广泛:

- 自我主权身份 (Self-Sovereign Identity, SSI):用户可以完全控制自己的数字身份,管理个人数据,并有选择地向 DApp 授予访问权限,而无需依赖中心化服务商。

- 通用 DApp 配置文件:用户可以在其 ERC-725 身份上存储一次个人资料(如用户名、头像),所有集成了该标准的 DApp 都可以读取这份资料,无需重复创建。

- 设备与物联网 (IoT):为物联网设备创建一个链上身份,使其能够自主地进行交易、注册或与其他设备交互。

- 组织与 DAO:为去中心化自治组织 (DAO) 创建一个身份,管理其成员、投票权和资产。

结论

ERC-725 是构建去中心化社会 (DeSoc) 和 Web3 的一个基础构件。它通过提供一个标准化的、可扩展的身份层,将以太坊从一个纯粹的金融交易网络,转变为一个能够承载复杂社会和经济活动的平台。随着账户抽象 (ERC-4337) 的普及,基于 ERC-725 的智能合约钱包有望成为未来用户进入 Web3 的主要入口。

ERC-777: Token Standard

与 ERC-20 的异同点

相同点

-

基本功能:

- 都支持代币的转账和余额查询

- 都实现了代币的基本属性(名称、符号、精度等)

- 都支持代币的授权机制

-

兼容性:

- ERC-777 完全兼容 ERC-20

- 可以通过 ERC-20 接口访问 ERC-777 代币

- 支持相同的代币查询方法

不同点

-

授权机制:

- ERC-20:使用 approve/transferFrom 模式,需要两步操作

- ERC-777:使用操作者(Operator)机制,更灵活且支持批量操作

-

转账通知:

- ERC-20:无内置通知机制,需要额外的事件监听

- ERC-777:提供内置的钩子函数(tokensReceived/tokensToSend)

-

数据支持:

- ERC-20:不支持在转账时附加额外数据

- ERC-777:支持在转账时附加任意数据(data 和 operatorData)

-

燃烧机制:

- ERC-20:无标准燃烧接口,需要自行实现

- ERC-777:提供标准燃烧接口,支持操作者燃烧

-

安全性:

- ERC-20:存在 approve/transferFrom 的安全隐患

- ERC-777:提供更安全的操作者机制和钩子函数

-

功能扩展:

- ERC-20:功能相对简单,扩展性有限

- ERC-777:支持更复杂的业务逻辑,扩展性更强

ERC-777 是一个以太坊代币标准,它在 ERC-20 的基础上进行了改进,提供了更高级的功能和更好的安全性。该标准由 Jacques Dafflon、Jordi Baylina 和 Thomas Shababi 于 2017 年 11 月提出。

标准概述

ERC-777 的主要目标是:

- 提供更直观的代币操作方式

- 改进 ERC-20 的批准机制

- 增加代币发送和接收的钩子函数

- 保持与 ERC-20 的向后兼容性

核心接口

interface IERC777 {

// 返回代币名称

function name() external view returns (string memory);

// 返回代币符号

function symbol() external view returns (string memory);

// 返回代币精度

function granularity() external view returns (uint256);

// 返回总供应量

function totalSupply() external view returns (uint256);

// 返回账户余额

function balanceOf(address holder) external view returns (uint256);

// 发送代币

function send(address recipient, uint256 amount, bytes calldata data) external;

// 燃烧代币

function burn(uint256 amount, bytes calldata data) external;

// 检查是否是操作者

function isOperatorFor(address operator, address tokenHolder) external view returns (bool);

// 授权操作者

function authorizeOperator(address operator) external;

// 撤销操作者

function revokeOperator(address operator) external;

// 默认操作者发送代币

function operatorSend(

address sender,

address recipient,

uint256 amount,

bytes calldata data,

bytes calldata operatorData

) external;

// 默认操作者燃烧代币

function operatorBurn(

address account,

uint256 amount,

bytes calldata data,

bytes calldata operatorData

) external;

}

interface IERC777Recipient {

// 代币接收钩子

function tokensReceived(

address operator,

address from,

address to,

uint256 amount,

bytes calldata data,

bytes calldata operatorData

) external;

}

interface IERC777Sender {

// 代币发送钩子

function tokensToSend(

address operator,

address from,

address to,

uint256 amount,

bytes calldata data,

bytes calldata operatorData

) external;

}

主要特性

-

钩子函数:

tokensReceived:接收代币时的回调tokensToSend:发送代币时的回调- 允许合约在代币转移时执行自定义逻辑

-

操作者机制:

- 替代 ERC-20 的 approve/transferFrom 模式

- 更灵活和安全的授权系统

- 支持批量操作

-

数据字段:

- 支持在转账时附加额外数据

- 便于实现更复杂的业务逻辑

-

向后兼容性:

- 完全兼容 ERC-20

- 可以通过 ERC-20 接口访问

安全考虑

-

重入攻击防护:

- 钩子函数可能被用于重入攻击

- 实现时需要使用重入锁或检查-效果-交互模式

-

操作者权限:

- 需要仔细管理操作者权限

- 建议实现操作者白名单机制

-

数据验证:

- 需要验证传入的数据

- 防止恶意数据导致合约异常

应用场景

-

代币化资产:

- 股票、债券等金融工具

- 房地产等实物资产

-

支付系统:

- 自动支付处理

- 订阅服务

-

投票系统:

- 代币持有者投票

- 治理机制

-

奖励系统:

- 忠诚度计划

- 空投分发

最佳实践

-

实现检查:

- 实现所有必需的功能

- 确保符合 ERC-777 标准

-

事件记录:

- 记录所有重要操作

- 包括发送、接收、授权等

-

错误处理:

- 提供清晰的错误信息

- 使用 revert 而不是 require

-

测试覆盖:

- 编写完整的测试用例

- 包括钩子函数和操作者功能

与 ERC-20 的区别

-

授权机制:

- ERC-20:使用 approve/transferFrom

- ERC-777:使用操作者机制

-

转账通知:

- ERC-20:无通知机制

- ERC-777:提供钩子函数

-

数据支持:

- ERC-20:不支持额外数据

- ERC-777:支持附加数据

-

燃烧机制:

- ERC-20:无标准燃烧接口

- ERC-777:提供标准燃烧接口

ERC-777 是一个功能更强大的代币标准,它在保持与 ERC-20 兼容的同时,提供了更灵活和安全的代币操作方式。通过钩子函数和操作者机制,它能够支持更复杂的业务场景,同时提供了更好的安全性保障。在实现时,需要注意安全性、兼容性和用户体验等方面。

ABI 定义

[

{

"constant": true,

"inputs": [],

"name": "name",

"outputs": [{ "name": "", "type": "string" }],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": true,

"inputs": [],

"name": "symbol",

"outputs": [{ "name": "", "type": "string" }],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": true,

"inputs": [],

"name": "granularity",

"outputs": [{ "name": "", "type": "uint256" }],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": true,

"inputs": [],

"name": "totalSupply",

"outputs": [{ "name": "", "type": "uint256" }],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": true,

"inputs": [{ "name": "holder", "type": "address" }],

"name": "balanceOf",

"outputs": [{ "name": "", "type": "uint256" }],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": false,

"inputs": [

{ "name": "recipient", "type": "address" },

{ "name": "amount", "type": "uint256" },

{ "name": "data", "type": "bytes" }

],

"name": "send",

"outputs": [],

"payable": false,

"stateMutability": "nonpayable",

"type": "function"

},

{

"constant": false,

"inputs": [

{ "name": "amount", "type": "uint256" },

{ "name": "data", "type": "bytes" }

],

"name": "burn",

"outputs": [],

"payable": false,

"stateMutability": "nonpayable",

"type": "function"

},

{

"constant": true,

"inputs": [

{ "name": "operator", "type": "address" },

{ "name": "tokenHolder", "type": "address" }

],

"name": "isOperatorFor",

"outputs": [{ "name": "", "type": "bool" }],

"payable": false,

"stateMutability": "view",

"type": "function"

},

{

"constant": false,

"inputs": [{ "name": "operator", "type": "address" }],

"name": "authorizeOperator",

"outputs": [],

"payable": false,

"stateMutability": "nonpayable",

"type": "function"

},

{

"constant": false,

"inputs": [{ "name": "operator", "type": "address" }],

"name": "revokeOperator",

"outputs": [],

"payable": false,

"stateMutability": "nonpayable",

"type": "function"

},

{

"constant": false,

"inputs": [

{ "name": "sender", "type": "address" },

{ "name": "recipient", "type": "address" },

{ "name": "amount", "type": "uint256" },

{ "name": "data", "type": "bytes" },

{ "name": "operatorData", "type": "bytes" }

],

"name": "operatorSend",

"outputs": [],

"payable": false,

"stateMutability": "nonpayable",

"type": "function"

},

{

"constant": false,

"inputs": [

{ "name": "account", "type": "address" },

{ "name": "amount", "type": "uint256" },

{ "name": "data", "type": "bytes" },

{ "name": "operatorData", "type": "bytes" }

],

"name": "operatorBurn",

"outputs": [],

"payable": false,

"stateMutability": "nonpayable",

"type": "function"

},

{

"anonymous": false,

"inputs": [

{ "indexed": true, "name": "operator", "type": "address" },

{ "indexed": true, "name": "to", "type": "address" },

{ "indexed": true, "name": "from", "type": "address" },

{ "indexed": false, "name": "amount", "type": "uint256" },

{ "indexed": false, "name": "data", "type": "bytes" },

{ "indexed": false, "name": "operatorData", "type": "bytes" }

],

"name": "Sent",

"type": "event"

},

{

"anonymous": false,

"inputs": [

{ "indexed": true, "name": "operator", "type": "address" },

{ "indexed": true, "name": "from", "type": "address" },

{ "indexed": false, "name": "amount", "type": "uint256" },

{ "indexed": false, "name": "data", "type": "bytes" },

{ "indexed": false, "name": "operatorData", "type": "bytes" }

],

"name": "Burned",

"type": "event"

},

{

"anonymous": false,

"inputs": [

{ "indexed": true, "name": "operator", "type": "address" },

{ "indexed": true, "name": "tokenHolder", "type": "address" }

],

"name": "AuthorizedOperator",

"type": "event"

},

{

"anonymous": false,

"inputs": [

{ "indexed": true, "name": "operator", "type": "address" },

{ "indexed": true, "name": "tokenHolder", "type": "address" }

],

"name": "RevokedOperator",

"type": "event"

}

]

EIP1155

ERC-1155 是一种以太坊代币标准,它定义了一种智能合约接口,可以管理多种代币类型。与 ERC-721(非同质化代币)和 ERC-20(同质化代币)不同,ERC-1155 允许在一个智能合约中同时处理这两种类型的代币,甚至还支持“半同质化”代币。

ERC-1155 的关键特性:

- 多重代币支持:

- ERC-1155 合约可以管理多种代币类型,包括:

- 同质化代币(如游戏中的金币或虚拟货币)

- 非同质化代币(如独特的游戏道具或数字艺术品)

- 半同质化代币(例如,一定数量的游戏门票,这些门票具有相同的属性,但是总数有限)

- ERC-1155 合约可以管理多种代币类型,包括:

- 批量转移:

- ERC-1155 允许一次交易转移多种代币,从而显著提高了效率并降低了 gas 成本。

- 高效性:

- 通过共享相同的合约逻辑,ERC-1155 减少了部署和管理多个合约的需要,从而节省了 gas 费用。

- 元数据 URI:

- ERC-1155 定义了一种标准的方法来存储代币的元数据(如名称、描述和图像),从而简化了数字资产的管理和显示。

- 安全转移:

- ERC-1155定义了安全转移代币的机制,避免了代币意外丢失或者被盗的情况。

ERC-1155 的应用场景:

- 游戏:

- 管理游戏中的各种资产,如道具、角色和货币。

- 数字艺术品:

- 表示限量版数字艺术品或收藏品。

- 供应链管理:

- 跟踪和管理供应链中的各种资产。

- 票务:

- 管理活动门票,优惠券等等。

ERC-1155 的优势:

- 提高了代币管理的灵活性和效率。

- 降低了交易成本。

- 简化了数字资产的开发和集成。

ERC-1155 方法:

balanceOf(address account, uint256 id):- 查询指定账户拥有的指定 ID 的代币数量。

balanceOfBatch(address[] accounts, uint256[] ids):- 批量查询多个账户拥有的多个 ID 的代币数量。

safeTransferFrom(address from, address to, uint256 id, uint256 amount, bytes data):- 安全地将指定数量的指定 ID 的代币从一个账户转移到另一个账户。

safeBatchTransferFrom(address from, address to, uint256[] ids, uint256[] amounts, bytes data):- 安全地批量将多个 ID 的代币从一个账户转移到另一个账户。

setApprovalForAll(address operator, bool approved):- 允许或禁止指定操作员代表调用者管理其所有代币。

isApprovedForAll(address account, address operator):- 查询指定操作员是否被授权代表指定账户管理其所有代币。

ERC-1155 事件:

TransferSingle(address operator, address from, address to, uint256 id, uint256 value):- 当单个代币被转移时发出。

TransferBatch(address operator, address from, address to, uint256[] ids, uint256[] values):- 当多个代币被批量转移时发出。

ApprovalForAll(address operator, address account, bool value):- 当操作员的授权状态发生变化时发出。

URI(string value, uint256 id):- 当代币的 URI(统一资源标识符)发生变化时发出。URI 通常指向包含代币元数据的 JSON 文件。

关键概念:

- ID:

- 用于唯一标识 ERC-1155 合约中不同代币的标识符。

- Amount:

- 表示要转移或查询的代币数量。

- Operator:

- 被授权代表账户管理代币的地址。

- URI:

- 统一资源标识符,指向代币元数据。

- 元数据:

- 对tokenId的描述,通常包括名称,描述,图片url等等信息。

[

{

"inputs": [

{

"internalType": "address",

"name": "account",

"type": "address"

},

{

"internalType": "uint256",

"name": "id",

"type": "uint256"

}

],

"name": "balanceOf",

"outputs": [

{

"internalType": "uint256",

"name": "",

"type": "uint256"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [

{

"internalType": "address[]",

"name": "accounts",

"type": "address[]"

},

{

"internalType": "uint256[]",

"name": "ids",

"type": "uint256[]"

}

],

"name": "balanceOfBatch",

"outputs": [

{

"internalType": "uint256[]",

"name": "",

"type": "uint256[]"

}

],

"stateMutability": "view",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "from",

"type": "address"

},

{

"internalType": "address",

"name": "to",

"type": "address"

},

{

"internalType": "uint256[]",

"name": "ids",

"type": "uint256[]"

},

{

"internalType": "uint256[]",

"name": "amounts",

"type": "uint256[]"

},

{

"internalType": "bytes",

"name": "data",

"type": "bytes"

}

],

"name": "safeBatchTransferFrom",

"outputs": [],

"stateMutability": "nonpayable",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "from",

"type": "address"

},

{

"internalType": "address",

"name": "to",

"type": "address"

},

{

"internalType": "uint256",

"name": "id",

"type": "uint256"

},

{

"internalType": "uint256",

"name": "amount",

"type": "uint256"

},

{

"internalType": "bytes",

"name": "data",

"type": "bytes"

}

],

"name": "safeTransferFrom",

"outputs": [],

"stateMutability": "nonpayable",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "operator",

"type": "address"

},

{

"internalType": "bool",

"name": "approved",

"type": "bool"

}

],

"name": "setApprovalForAll",

"outputs": [],

"stateMutability": "nonpayable",

"type": "function"

},

{

"inputs": [

{

"internalType": "address",

"name": "account",

"type": "address"

},

{

"internalType": "address",

"name": "operator",

"type": "address"

}

],

"name": "isApprovedForAll",

"outputs": [

{

"internalType": "bool",

"name": "",

"type": "bool"

}

],

"stateMutability": "view",

"type": "function"

},

{

"anonymous": false,

"inputs": [

{

"indexed": true,

"internalType": "address",

"name": "operator",

"type": "address"

},

{

"indexed": true,

"internalType": "address",

"name": "from",

"type": "address"

},

{

"indexed": true,

"internalType": "address",

"name": "to",

"type": "address"

},

{

"indexed": false,

"internalType": "uint256[]",

"name": "ids",

"type": "uint256[]"

},

{

"indexed": false,

"internalType": "uint256[]",

"name": "values",

"type": "uint256[]"

}

],

"name": "TransferBatch",

"type": "event"

},

{

"anonymous": false,

"inputs": [

{

"indexed": true,

"internalType": "address",

"name": "operator",

"type": "address"

},

{

"indexed": true,

"internalType": "address",

"name": "from",

"type": "address"

},

{

"indexed": true,

"internalType": "address",

"name": "to",

"type": "address"

},

{

"indexed": false,

"internalType": "uint256",

"name": "id",

"type": "uint256"

},

{

"indexed": false,

"internalType": "uint256",

"name": "value",

"type": "uint256"

}

],

"name": "TransferSingle",

"type": "event"

},

{

"anonymous": false,

"inputs": [

{

"indexed": true,

"internalType": "address",

"name": "operator",

"type": "address"

},

{

"indexed": true,

"internalType": "address",

"name": "account",

"type": "address"

},

{

"indexed": false,

"internalType": "bool",

"name": "value",

"type": "bool"

}

],

"name": "ApprovalForAll",

"type": "event"

},

{

"anonymous": false,

"inputs": [

{

"indexed": false,

"internalType": "string",

"name": "value",

"type": "string"

},

{

"indexed": true,

"internalType": "uint256",

"name": "id",

"type": "uint256"

}

],

"name": "URI",

"type": "event"

}

]

EIP2612

EIP3009

ERC-4337: 无需修改共识层的账户抽象

摘要

ERC-4337 是在不改变以太坊共识层协议的情况下实现账户抽象(Account Abstraction, AA)的以太坊标准。它通过引入一个更高层的伪交易对象 UserOperation,以及一系列新的角色(Bundler, Paymaster),使得用户可以使用智能合约作为其主账户,从而实现多签、社交恢复、Gas 费代付等高级功能,极大地改善了用户体验。

1. 背景:为什么需要账户抽象?

在以太坊中,账户分为两类:

-

外部拥有账户 (Externally Owned Account, EOA):

- 由公私钥对控制。

- 能够发起交易(支付 Gas)和签署消息。

- 缺点:私钥丢失意味着资产永久丢失,无法实现复杂逻辑(如多签、限额),每次交易都需要用户手动签名。

-

合约账户 (Contract Account, CA):

- 由代码逻辑控制,没有私钥。

- 可以实现任意复杂的逻辑。

- 缺点:无法主动发起交易,只能被 EOA 或其他合约调用。

这种二元结构导致了糟糕的用户体验。例如,用户需要用 EOA 来调用合约钱包,并且必须持有 ETH 来支付 Gas 费。账户抽象的目标是模糊这两者的界限,让用户可以直接使用一个具有可编程逻辑的智能合约账户来发起交易。

2. ERC-4337 核心思想

ERC-4337 的巧妙之处在于,它完全避开了对核心协议的修改。它在应用层实现了一个独立的 UserOperation 内存池,并引入了一个特殊的角色——Bundler。

- 用户 (User):不再直接发送传统的

transaction,而是创建一个描述其意图的UserOperation对象,并将其发送到一个专门的 P2P 内存池。 - 打包者 (Bundler):一个类似于矿工/验证者的节点,它从内存池中抓取一批

UserOperation,将它们打包成一个标准的transaction,然后发送到链上的全局入口点合约 (EntryPoint)。 - 入口点合约 (EntryPoint):一个全局单例合约,负责验证和执行打包好的

UserOperation。它是整个系统的信任和安全中心。

这个流程将用户的复杂操作(如调用某个合约)封装在 UserOperation 中,而由 Bundler 负责将其“翻译”成一笔能在以太坊上执行的真实交易。

3. 核心组件详解

ERC-4337 定义了几个关键的链上合约和链下角色。

链上组件

-